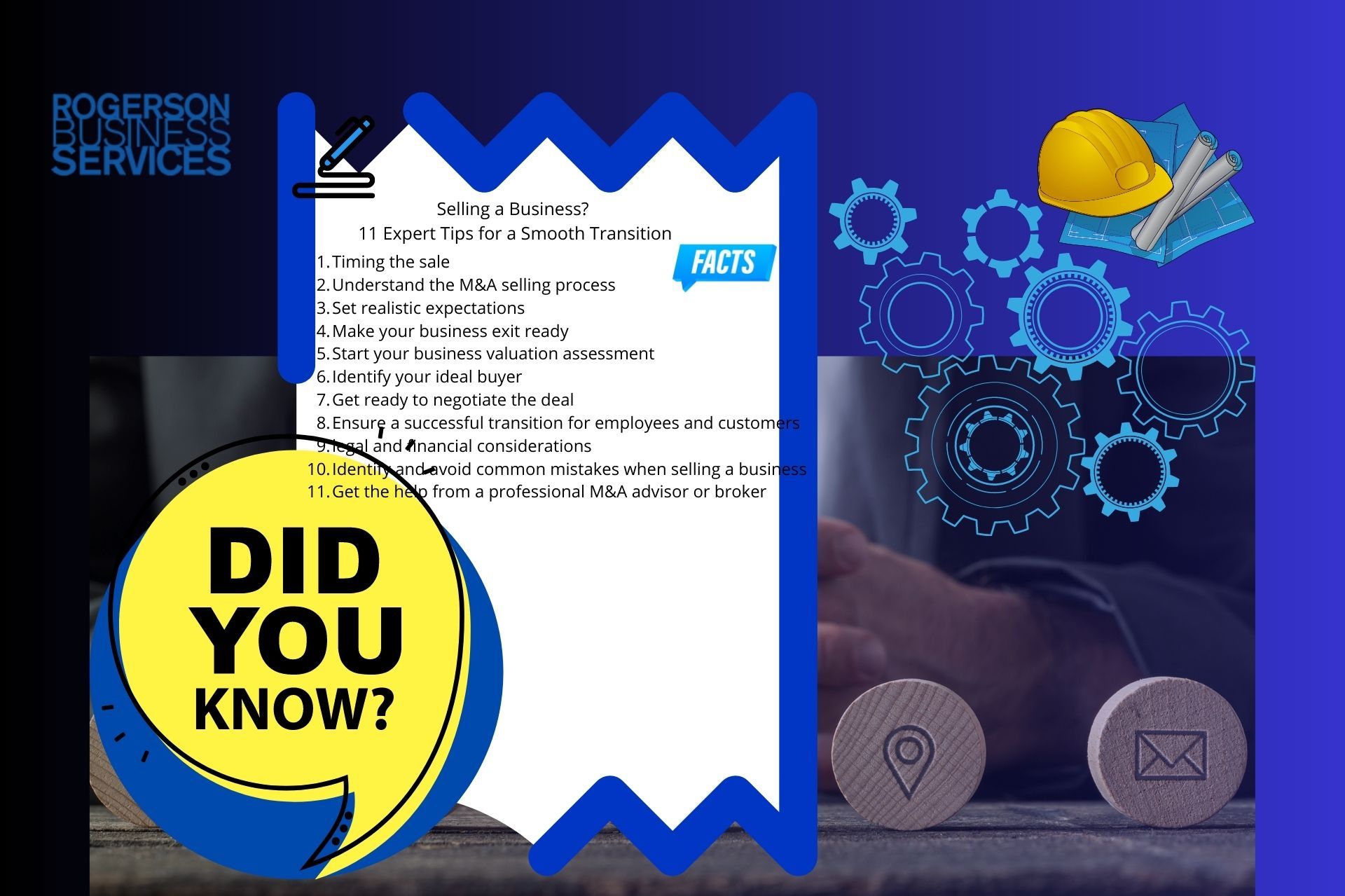

5 Reasons: Why Hire an M&A Intermediary When Selling a Professional Services Business

Why Hire an M&A Intermediary?

- Reason One: Find business worth

- Reason Two: Help get your business positioned for sale

- Reason Three: Sell your business quickly

- Reason Four: Help in adding business value

- Reason Five: Help sell your business at top dollar

An M&A intermediary can help sell your California lower middle-market company in the service business sector, especially if a business owner decides to go all the way alone. It involves tackling many things right from preparing to sell, initiating the selling process, and closing the deal.

Remember, you still need to do what you do best—run the business. So why go the hard way when a professional service business M&A intermediary can help with the process?

Are you a California professional services business owner looking to sell your service business for top dollar? Here’s why you should hire a merger and acquisition intermediary.

M&A Service Business Intermediary?

An M&A business broker assists business owners in valuing their businesses. They also help take them to the market and find the right buyer to pay the highest to acquire the company.

A service business M&A intermediary doesn’t stop at that. They assist in all the steps involved in preparing the business for sale.

Some of the most vital roles of merger and acquisition advisors are:

- Working with business owners, board of directors, company accountants, and CPAs to help value the business and sell it the right way, maintaining the highest standards.

- They help with showing the business to prospective buyers.

- They save business owners the hassle of contacting buyers and negotiating the sale. That way, CEOs can focus on playing their role of overseeing the smooth running of the service business.

- They ensure the business sticks to an exit strategy and that all the framework is secure. Additionally, they join business owners in keeping details regarding the sale of the service company confidential. Competitors and employees must not know the company is for sale.

- To ultimately ensure the smooth proceeding of the sale transaction. They have to leave all the parties involved satisfied and with all their interests well-served.

How the M&A Intermediary Can Add Value

Before you can put your service business on sale, you need some preparation. That’s because it’s not an overnight process but something that may take several months.

After preparation, you then put the business on sale and close the deal. In all these stages, an M&A advisor adds significant value to the process.

As you lay down your exit strategy framework, an M&A consultant works hand in hand with you to manage the following steps in the sale of the company:

- Valuing the business: The M&A broker works closely with other financial experts to help value the business. They advise on the valuation methods that get you the best price and within the market range.

- Assisting with documentation: They help with preparing documents used during the sale. These include papers that you present to the market to make the company attractive to potential buyers. Other documents hide the fact that the business is on sale from the market. In addition, the broker will help create and write papers that you, as the company owner, will share with a buyer upon signing a non-disclosure agreement (NDA).

- Contacting potential buyers: The M&A advisor acts on behalf of the service company to contact prospective buyers. These include those who may have expressed interest in acquiring the business and those CEOs the company knows would be interested in buying the business.

- Conducting interviews: The consultant will help to interview potential buyers. The more the offers, the longer the process may take.

- Selecting motivated buyers who qualify: This would also involve taking them through the signing of the NDA and confidentiality agreement.

- Due diligence: They assist the selling company and the buyer with the due diligence process.

- Negotiations. They help with negotiating the available offers with the buyers to help reach an agreement.

- Obtaining finance: They guide the buyer on the steps to follow in getting the finances to acquire the business.

- Assisting with the transfer of ownership process, and ultimately, fruitful closing of the deal.

How Can I Sell My Business Quickly?

You want to sell your service business as quickly as possible and at the highest price.

With the help of a professional service business M&A business broker, you can speed up the sale process. However, it calls for a proper plan.

The following tips will help you close the deal quicker.

Have Accounting Records at Hand

Have a set of accounting records with you to make it easy for potential buyers to estimate the business value. This should include updated records complying with accounting standards, budgets, cash flow forecasts, and business plans.

Industry analysis and benchmarks also go a long way in helping speed up the process.

Document All Your Business Operations

Your business operations include a procedure manual, third-party service providers’ contracts, employee agreements, organization chart, and automated processes.

With a clear picture of how the business operates, buyers can easily plan its operation upon acquisition, so they will likely buy it.

A Marketing Plan Is Key

A marketing plan is a document every buyer would be interested in.

It shows how you survive competition, what distinguishes you from your competitors, how you generate leads, increase brand awareness, and attract prospects. It makes a buyer confident the plan will work with them too.

Hire a Reputable M&A Firm

We’ve just highlighted how vital an M&A intermediary is in the sale of a service business above. Engaging one can only speed up the process.

Seek the Right Buyers

Have your broker draft plans that target prospective buyers. These include CEOs of competing companies, retired executives, or any other private firm interested in the industry.

Done right, this may result in selling faster than you ever expected.

Be Available

Often, sale transactions take a long time because one of the parties isn’t collaborating enough.

For the transition to be effective, smooth, and quick, work with all stakeholders during the after-sale process. By doing so, you make the takeover easy for everyone, and in case of any concerns, you’re available to address them accordingly.

How to Get Acquired by a Bigger Company

To maximize the chances of a bigger company acquiring you, prepare well in advance. Here are some highly beneficial tips on how to get acquired.

Market Your business

The acquirer is not only interested in your service but the business itself too. They want to know that they’re acquiring a business that will add value to their company.

Otherwise, your products may be great, but you have not done enough to portray it as a business that’s going places.

Explore Product Synergies

With the help of your M&A intermediary, you can explore and test potential product partnerships on prospective acquirers before considering selling your service company.

If the partnership with a bigger company works, the acquisition will be better and more valuable than selling.

Have the Right Advisors

One of the best advisors to include in your advisory board is an M&A business broker. By involving a broker and other influential and senior people who have little stake in your company, finding a bigger company to acquire you may be easy.

Great relationships can be that secret card you need to pull and leverage with potential acquirers.

Final Word

Selling a business in California involves several steps. To guarantee a smooth sale process, hiring a merger and acquisition broker is a great idea. As mentioned, these professionals can be vital valuable in ensuring you do everything correctly without missing a single crucial step.

An M&A advisor also helps save time and money while ensuring your business gets into safe hands after the exit.

If you are a retiring business owner looking to exit your lower middle market service business in California, here are six tips to get you started:

1. Don't wait until the last minute to start planning your exit. The process of selling a lower middle market service business can take a long time, so it's important to start early.

2. Have a clear idea of what you want to get out of the sale. Know your goals and what you're willing to negotiate.

3. Know what's your company's worth. This is an essential step to take when planning to sell your service business company in California.

4. Choose the right type of buyer. Not all buyers are created equal, so do your research and find the right one for your business.

5. Be prepared for a lot of due diligence. M&A buy-side due diligence is when buyers will want to know everything about your business, so be ready to provide documentation and answer questions.

6. Be flexible with the terms and conditions of the deal. It's important to be open to negotiation to get the best possible deal for your business.

Rogerson Business Services, also known as, California's lower middle market business broker is a sell-side M&A advisory firm that has closed hundreds of lower middle-market deals in California. We are dedicated to helping our clients maximize value and achieve their desired outcomes.

We have a deep understanding of the Californian market and an extensive network of buyers, which allows us to get the best possible price for our clients. We also provide comprehensive support throughout the entire process, from initial valuation to post-closing integration.

Our hands-on approach and commitment to our client's success set us apart from other firms in the industry. If you consider selling your lower middle market service business, we would be honored to help you navigate the process and realize your goals.

If you have decided to value and then sell your lower middle market service company or still not ready, get started here, or call toll-free 1-844-414-9600 and leave a voice message with your question and get it answered within 24 hours. The deal team is spearheaded by Andrew Rogerson, Certified M&A Advisor, he will personally review and understand your pain point/s and prioritize your inquiry with Rogerson Business Services, RBS Advisor

Go to the next article: Part of tips to selling business services company in California series ->

More Tips to Help Sell a Lower Middle Market Business Services Company

Have Questions? We've Got Answers

We will get back to you as soon as possible.

Please try again later.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.

Sign up to our MMB newsletter

Thank you for joining us.

Check your email for our monthly newsletter

Please try again later

Reach out to any of our Deal Team & Advisors for a confidential conversation to see if we are a good fit.

We Help You Maximize The Value Of Your Business Before Selling it

Toll-Free

(844) 414-9600

5150 Fair Oaks Blvd, #101-198

Carmichael, CA, 95608

CA DRE# 01861204

Rogerson Business Services - Lower Middle Market Advisory

Read our Privacy Policy

Read our Accessibility Policy

M&A Knowledge Hub

THIS SITE IS DESIGNED AND POWERED BY INBOUNDEALZ