The Ultimate Guide To Help Sell A Manufacturing Business

Considering selling a manufacturing business in the lower middle-market segment can be overwhelming in California. Without a proper, well prepared, exit plan, and a manufacturing business broker or professional business M&A Advisor to facilitate the sell-side M&A process, there is no way to guarantee that you made the right decision.

Get The Guide

M&A Guide

Increase Your Chance Of Success!

Guide to help exit a manufacturing company

Everything you need, all in this sell a manufacturing business guide

Sell a Manufacturing Business Guide

Table of Contents

Sell a Manufacturing Company

As the owner of a lower middle-market Manufacturing business, you may be wondering when is the right time to sell. Your business may be doing well, making it the best time to exit so you can get the best price possible and invest some of the money in a more secure investment. You may also be ready to move on to the next phase of your life or even ready to start a new project.

Retirement is often a time to shift your focus to other matters beyond your business. You've worked hard your entire life, and it's time to reap the rewards. If you own a manufacturing company in California, you may be thinking of selling. Exiting your California manufacturing business can give you the financial freedom to enjoy your golden years.

Whether you are ready to exit next week or in the next few years, you need to get an exit plan in place. An exit strategy will help you get in everything in order so that when the time is right, you're ready to sell. You must go through the proper steps to selling your business so that you can get the best financial returns.

Considering an Exit Strategy

There are many steps to sell your manufacturing business, and you will need an exit strategy if you want things to go smoothly and ensure you get the most out of your sale. You can sell the business outright, or you may want to consider selling to a family member or key employee first. You can sell to an individual or look to sell to a bigger company within your industry.

There are many ways to go about selling your business. One method isn't necessarily better than the other. Your decisions will come down to the unique factors around you and your business. You will need to think about your business and what will work best. You may also want to work with an M&A Advisor who has experience in selling manufacturing businesses. Their guidance will help you

develop the best

business exit strategy.

Top Reasons to Exit Your Manufacturing Company

There are many reasons you may want to exit your manufacturing company - here are five reasons to start thinking about an

exit plan.

1. You are Ready to Move On to Another Stage in Your Life

While you may love your business, you may be ready to move on to the next phase of your life. Perhaps you have made enough money to be comfortable for the rest of your life, and you are ready to enjoy your time relaxing, pursuing hobbies, and spending time with your family.

2. Burnout and Exhaustion

While you may have been excited about working long hours and putting in a lot of effort when you first started your business, that pace can get exhausting over time. You may find that you need a break. With too much time spent working, you may face burnout and the slow decline in your business.

You may even feel overwhelmed by the enormity of running a company, or you may have other things you’d like to prioritize in life. The ups and downs of owning a business and the constant stress of knowing that so many people depend on you can take their toll over time. You may be ready to let someone else take over and focus your energy elsewhere.

3. Your Business Has Scaled Quickly and Is Ready for an IPO

In some cases, your business might have grown much faster than you'd anticipated. If so, it might be time to open up to public investors, but there are many stipulations to meet before you can consider an IPO. You will need a lot of customers, at least $10 million in earnings over the past three years, and more. If your business is the right fit, an IPO can serve as a great exit plan that will allow your business to keep growing while you can limit your involvement.

4. Uncertainty in Your Market

While your business may be doing well right now, you may sense some upcoming changes in the market on industry that may affect your performance. Maybe trends show that people are changing how they spend their money and may not spend as much in your industry. Perhaps there is a bigger competitor who may outperform you.

In California’s current business climate, there are few industry events where you can promote your business. Trends are also showing that certain industry sectors are succeeding while some are on the decline. If your industry is on the decline, this may be another reason to sell.

Sometimes these shifts are temporary, and you can weather the storm. In other cases, changes are long term and could spell trouble for your industry and therefore your business. In these cases, it's best to have an exit strategy in place.

5. You're Looking for a New Project

Entrepreneurs are a special breed. They can put their hearts and souls into a project, but once they have overcome the challenges and created a successful business, they can be ready to move on to the next project. If you have this same buy-and-flip spirit, you are likely a serial entrepreneur.

You have led your manufacturing business to success. Now you're ready to start from the ground up with a new venture. In this case, it is best to sell and take some of your money 'off the table' and put into your next project.

Business Valuation

What is it? Why do I need one if I am planning to sell a business? What is my business worth?

How to Sell a Manufacturing Business

Selling a manufacturing business can be a long and complicated process. Even with a good exit strategy in place, you will face many hurdles, lots of paperwork, and potential setbacks.

Here are 12 steps to help you learn more about how to sell a manufacturing business and how to make your company more appealing than others on the market.

Preparing to Sell a Manufacturing Business

1. Think Like a Buyer

When preparing lower middle market businesses for sale, you need to start by thinking like a buyer. You know your company is great, but how would an outsider see it? Imagine you're buying a company and trying to do your due diligence. What would you look for? What might be a red flag? If you can get in this mindset, you can rectify factors that may turn off potential buyers and prevent any setbacks.

2. Get Your Paperwork in Order

One of the first things a potential buyer will want to see is your documents. It can take a while to get these in order, so it's best to start gathering and organizing long before you put your business on the market.

Some of the paperwork you will need includes:

- Tax returns and financial statements from at least the past three years

- Different markets you serve in your business and the portions of your income that come from each market

- A list of your ten highest volume customers and the amount you make from each

- A list of aging accounts receivable and payable

- A list of all the equipment in your facility, with year, make, model and serial number an other details on each

- An inventory list

- Detailed information about employees (you won't distribute this information during the initial stages of selling)

This list is by no means exhaustive. You'll need to prepare much more before putting your business on the market. Once you find potential buyers, they may have requests for other types of documentation as well.

3. Make Sure Your Staff Is Trained to Function Without You

Many manufacturer owners have trouble delegating tasks and wind up doing much of the work themselves. While no one knows your company the way you do, it's important to make sure your staff can carry on with the majority of your business's functions when you're not there.

If you are the only one who knows how to do a large part of the business, you may turn off potential buyers. Most

M&A buyers

want a turnkey business, not an investment where they will have to spend hours training employees or taking over the bulk of the work. As an added benefit, by training your employees, you are ensuring that the business can function as you transition out.

4. Ensure That Your Entire Staff Isn't Ready for Retirement

If you've owned your lower mid-market manufacturing company for a while, you likely have quite a few loyal key employees who have been with you for quite a long time. While these employees have helped to make your business what it is, if most of your staff is nearing retirement with you, a potential buyer may be put off.

You do not want to lose your valued employees, but attracting new hires can assure potential buyers that the company is ready to keep going. You may even want to consider an internship program to help train new employees.

5. Write Down Your Processes

Many manufacturing business owners have a system of running their business that is entirely in their heads. You know the ins and outs of your business and you are the one who keeps everything running. While this may work as long as you are with the company, a potential buyer will want to know what processes are in place.

Therefore, you need to create an operations manual for each of your processes. Work with your employees to develop this manual by getting everyone to detail exactly what they do. Potential buyers will be impressed with a company that's ready to go as soon as the change of ownership happens, and your purchase price potential will be greater. As a bonus, if your employees are trained to do what you do, your business will carry on just fine, even if you have to be out for an extended period or if an employee leaves your company.

6. Get Everything in Tip-Top Shape

If you have neglected cleaning and organizing your facility, it's time to get it in order. Go over everything, from machinery to inventory to paperwork. Get rid of anything you do not need and clean up everything else. Paperwork should be organized, and the manufacturing floor should be clean. Depending on what you manufacture, it may not be possible to get everything perfectly orderly, but make your best attempt (or hire someone to).

Think of your business as a home. You would not try to sell a home that was dirty and in disarray. A messy business will put off potential buyers and make them worry that maybe everything is not in good working order, while a clean, organized one will send signals that everything operates smoothly.

7. Check Environmental Law

If your California manufacturing business isn't following local and federal laws, most buyers will turn away immediately. Read up on the laws and go through every step of your process to ensure you are in compliance. Also, make sure that all relevant employees understand the law.

If you find that any aspect of your process is noncompliant, do what you need to do to fix the issue. It can be costly to make your business compliant, but it will save you in the long run.

8. Make Sure That All Records Are Accurate

Go through your records and make sure that everything is up to date and completely accurate. A potential buyer will certainly do their due diligence, and if it looks like you’re not completely truthful, they'll head elsewhere.

Go through your records of profits and losses and make sure they line up with what's stated on your tax return. If your records and tax returns do not match, do not try to fix this issue yourself. You will need a CPA to reconcile the two, and you will also need a reasonable explanation for why there was an incongruence in the first place.

9. Get Up to Date on All Financial Obligations

A buyer does not want to have a business that has a multitude of unresolved financial transactions. Make sure everything is current when it comes to money because no buyer wants to take on a business with a lot of pre-existing obligations.

Simply put, if you have any accounts you have not paid, take care of them as quickly as possible. If clients owe you, work to get their accounts current. If you owe anything in taxes, make sure to pay. Also check to see if your business has any liens in place. Your finances should be clear and ready to go when you hand over your business.

10. Discuss Everything With Your CPA

Once you've gathered and organized all of your financial documents, it's necessary to review everything with your CPA. Your CPA can look over everything, make sure you’re current and tax-compliant, and advise you on any errors.

A CPA can also help you create records that show the true potential of your business. In most cases, the tax records of your business are set up to prevent paying a lot back in taxes. However, once it is time to put your business up for sale, you will want records to show your business's potential for profits. It is important to let a CPA restructure these records instead of doing it yourself.

Additionally, you need to consider the taxes you will pay after the sale. A CPA can help you go over the terms and help you figure out how much profit you will have left after paying taxes. It is especially important to see how much you will actually get if you are retiring, as you'll want to ensure you have enough to maintain your current quality of life.

11. Decide What You will Do After the Sale

While you may spend a year or more getting everything prepared to sell your California manufacturing business, you may have given very little thought to what you are going to do after the sale is finalized. What will be your role, if any, in the business? What will you do with your free time?

Letting go of a business is difficult for any entrepreneur, especially one that you have built from the ground up. You need to mentally prepare yourself to walk away. By deciding exactly what you are going to do after you sell your business, you won't spend the first few months after selling with nothing to do.

12. Hire a Manufacturing Business Broker

The steps to creating a business owner exit strategy and selling your manufacturing business are arduous and complicated. It can take you many hours to get everything in order. If you are still working full-time running your business, you simply may not have the time to do both. By trying to do everything, you may wind up making errors both with your business and your exit strategy.

If this situation applies to you, you may want to

hire a manufacturing business broker. An

RBS Advisor knows exactly what to get your California manufacturing business ready for sale. They can guide you through each step of the process, help you avoid any errors, make your business more attractive to buyers, and ultimately help you get a better price.

You will also get the feeling of security in knowing that every step of your

business exit strategy planning

is being handled by a professional. You can keep your focus on running your manufacturing business and know that when the time is right, you will be

ready to sell.

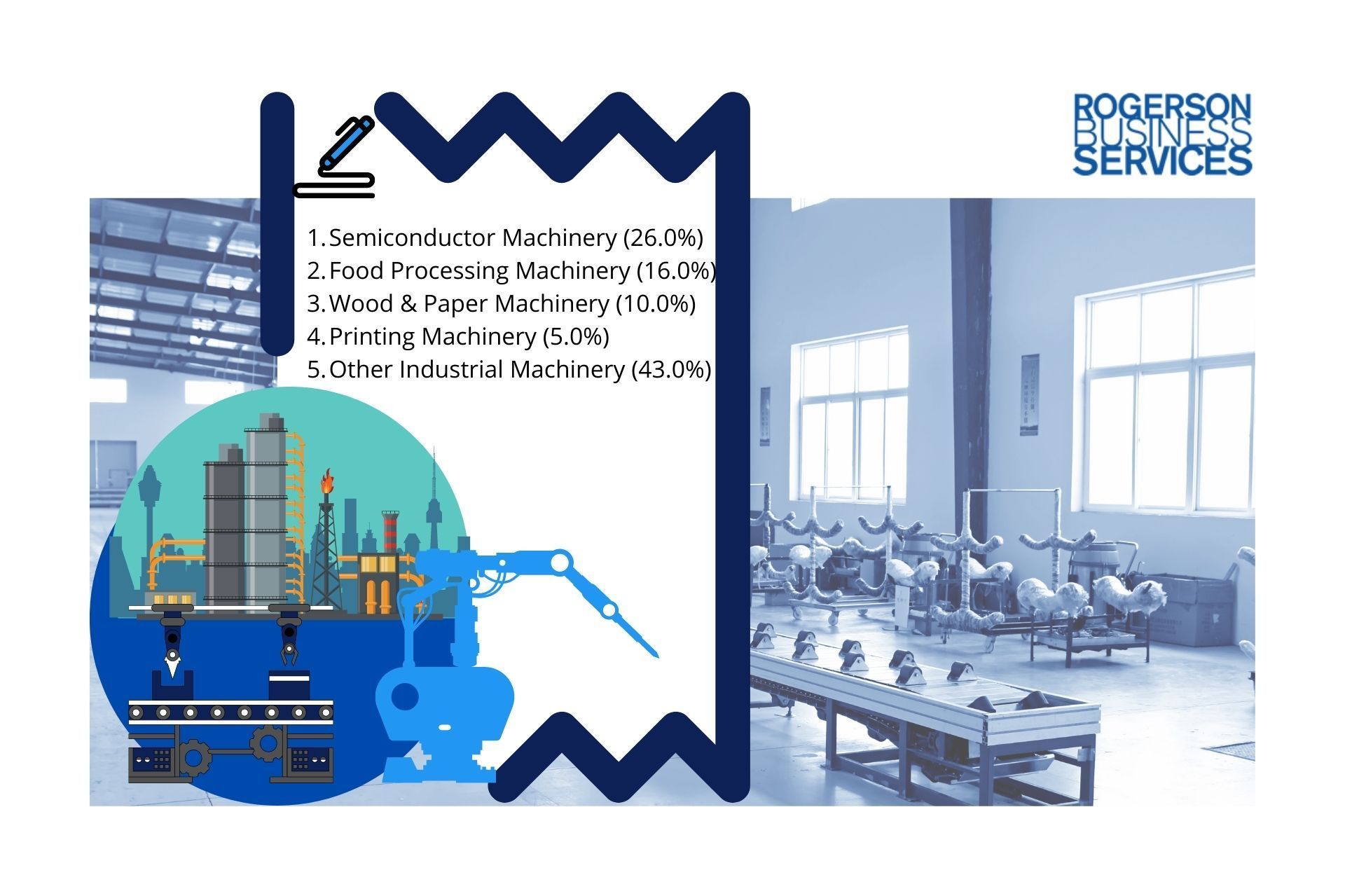

Types of Manufacturing Businesses for Sale

There are many California manufacturing businesses for sale. Some mid-market businesses for sale include:

- Cosmetics Manufacturing Business for Sale

- Chemical Manufacturing Business for Sale

- Chemical Factory for Sale

- Chemical Manufacturer for Sale

- Detergent Manufacturers

- Private Label Detergent Manufacturers

- Medical Products Manufacturers

- Pharmaceutical Companies for Sale

- Generic Pharmaceutical Companies for Sale

- Glass Manufacturing Business for Sale

- Window Manufacturing Business for Sale

- Mattress Manufacturer for Sale

- Bicycle Manufacturing Business for Sale

- Food Manufacturing Business for Sale

- Furniture Manufacturer for Sale

- Medical Devices Manufacturer for Sale

- Machinery and Industry Products Manufacturer for Sale

Selling a Manufacturing Business - Focused Business Sectors

There are many attractive manufacturing business sectors that we see a high demand of investors and strategic buyers looking to acquire in California. Most popular manufacturers that are hot for mergers and acquisitions in the lower middle market are:

- Selling a Food Manufacturing Business

- Selling a Furniture Manufacturing Business

- Selling a Medical Devices Manufacturing Business

- Selling a Machinery Manufacturing Business

- Selling a Cosmetics Manufacturing Business

- Selling an Industrial Equipment Manufacturing Business

- Selling a Signage and Printing Manufacturing Business

- Selling a Paper Products Manufacturing Business

- Selling a Drone and Aviation equipment Manufacturing Business

Seller Due Diligence

While there is a lot of focus on buyer due diligence, it is also important to consider seller due diligence as well. You may even want to create a due diligence checklist for selling a business. During a due diligence process, the buyer may ask you for certain records or documents, and these may be items that you did not gather during the creation of your exit plan.

These requests are perfectly normal and to be expected, but as a seller, you want to try to anticipate what the buyer may ask for. Again, it's a good time to think like a buyer. What would they want to know before

purchasing your business? Organize your paperwork to the best of your abilities. If a buyer asks for something during the due diligence process, you want to produce it as quickly as possible. If you spend a long time trying to find something, the

selling process

may be delayed and the buyer may move on.

You also want to be careful when it comes to your employees. You may be reluctant to say much to your employees, for fear they may leave before the business changes hands. At the same time, you also want to be careful not to bring in a buyer that plans to completely change the workforce or their benefits.

Learn how to plan an exit for your manufacturing company

Sell-Side M&A

Four step process to market your California lower middle market manufacturing business for sale

01 Exit Plan - business valuation

Your potential buyers can come from many areas. Employees, individual and group investors, Private Equity Groups, and even competitors who may have an interest in purchasing your manufacturing business. If a competitor is interested, you don't want to reveal too much information about your business, especially anything that could hurt your business if the deal falls through.

Once you decide to sell, get your business ready, and get help from a trusted and accredited California M&A Advisor.

An M&A Advisor will vet potential buyers to make sure they are qualified and are serious about purchasing your manufacturing business.

A California Licensed M&A Advisor knows the ins and outs of selling a California manufacturing business and can help you get your business in shape to get you the best deal.

02 Buyer Analysis

One of the first things your M&A Advisor will do, is help you to create an exit plan. A manufacturing business broker knows exactly how to plan an M&A exit strategy. In fact, you might get an Advisor to help you with an exit plan long before you're ready to sell your California manufacturing company.

An business manufacturing broker is knowledgeable about how to calculate the value of a business to sell and will aim to get the highest value for your factory. Once everything is ready to go, they'll list your business for sale. An M&A Advisor will be an expert at listing a California manufacturing businesses for sale.

After your business is listed, the Advisor will handle all the

marketing of your business to promote deal origination and get you in front of potential buyers. They'll also set a buyer list and work with you to figure out who to go after for the best value.

03 Deal Origination - marketing

An RBS Advisor will then work to get you as many qualified and motivated buyers of your manufacturing business as possible.

They will market your business through the proper channels, including social selling and targeting and generating interest. They'll vet and follow up with interested buyers whether off-market or publicly listed.

Once the offers come in, your RBS Advisor will evaluate all offers and conduct market offer analysis to make sure you're getting the best deal.

04 Negotiation & Closing

Buyer Due Diligence

Once a buyer is performing their own due diligence, the RBS Advisor will help you navigate the process to make sure everything is running smoothly. They'll negotiate a Letter Of Intent between you and the buyer to lay out the proposed aspects of the deal. Your M&A advisor will also help you gather all of the necessary paperwork discussed above. If the buyer asks for additional documentation, your middle market merger and acquisition consultant can help guide you.

As a buyer is going through the due diligence process, they will be on the lookout for red flags about your business. An experienced

business manufacturing broker is knowledgeable about these warning signs and can help you prevent them. Red flags may include refusing to disclose why you're selling, not allowing time to conduct due diligence, refusal to introduce the buyer to employees, suppliers, landlords, and more.

Definitive Purchase Agreement

The Merger and acquisition broker will oversee the Definitive Purchase Agreement with the help of the transaction attorneys to make sure both parties are happy with the terms. A Definitive Purchase Agreement protects both you and the buyer as it will clearly state exactly what is and is not being sold. It can also protect the buyer from certain liabilities. A Definitive Purchase Agreement will also help you deal with the legal complexities of selling a California lower middle market business.

Once the Definitive Purchase Agreement is finalized, the M&A Advisor will help with any final items that need to be done as part of the closing process including working with a California Licensed Escrow company.

Closing - Finalize the Transaction and Close the Deal

Finally, your Advisor will help prepare the close of your transaction. Once the closing is complete, they'll assist with overseeing the transition of the business change of ownership.

Business Valuation - What is It Worth?

One of the biggest questions you likely have, even before putting your business on the market, is, "How much is my business worth?" There isn't a simple formula where you can plug in costs and profits to figure out what the true value of your manufacturing business. Instead, the process is somewhat more nuanced. Below, we've listed 15 of the top things that affect the valuation of your business.

1. There Are Many Ways to Look at Profits

For the most part, potential buyers want a business that's making money, and preferably one that is steadily increasing its earnings. Graphs of your net sales over the past few years will be helpful, especially if they show an upward trajectory. A buyer, particularly an M&A strategic buyer, will look at your profits from different perspectives. They'll look at how much you're selling, your Cost of Goods, labor costs, material purchase costs, fixed and variable overheads and compare them with your net earnings.

A higher margin indicates a business that is well-run. It likely has good employees, processes, and relationships with distributors. If your company has a gross margin of less than 35%, start looking at where you can make some changes to reduce your costs. Most buyers will pass on companies with a gross margin of less than 35%.

2. Don't Just Look at Your Assets Vs. Your Liabilities

If you ask some people, "how much is my business worth?" they may give you a short answer to subtract your liabilities from your assets, and the difference will be what your manufacturing business is worth. This method is not the best for determining the true value of your business, and you could wind up selling yourself short.

You may want to look into preparing an

EBITDA

(Earnings Before Interest, Taxes, Depreciation and Amortization) or an SDE (Seller's Discretionary Earnings) analysis if you want to know how to value a business based on revenue. These statements can give you a better idea of what your business is worth and give potential buyers a better idea of how your business is performing.

3. The Owner and Transition Can Affect Value

If your manufacturing business is completely reliant on you to get anything done, that could lower its value to potential buyers. While you may do a great job of running the business, they will see a business that will need a lot of restructuring once you are gone.

How willing you are to participate in a transition period will also affect value. If you are able to stay on for a transition period, your business's value can go up.

4. Where Your Revenue Comes From

If a large portion of your revenue comes from a few customers or a small sector, your manufacturing business may have a lower value. A buyer may worry about what could happen to the business's revenue if one of those significant customers decide to take their business elsewhere. You may want to spend some time diversifying your client base before valuing your business.

5. Your Ties With Customers

If you have several long-standing customers who place regular orders throughout the year, your business may be valued higher. A buyer will see your business as more of a sure thing than a business that has a revolving door of customers.

6. How Easy It Is to Do What You Do

If you offer something unique in your field, you can often get a higher price for your business. You may manufacture something that is unique, that is of high quality, or use a process that sets you apart from other lower mid-market companies for sale. All of these things can make your business more lucrative to buyers.

7. Patents

If you have any patented products, unique products, or technologies, your value may go up. Basically, anything that sets your business apart from others can make it more valuable.

8. New Technologies May Negate the Need for Your Business

Manufacturing companies are always in danger from new technologies. If whatever you manufacture is about to be produced for cheaper and easier by technology, your business may not be worth as much.

9. How Much Money a New Owner Will Have to Invest Into a Business

If you have not made any capital investments in your business, such as purchasing new or used manufacturing equipment, the new owner may be required to spend a lot of capital when coming in to keep up with other businesses in your industry. Investing in up-to-date equipment can make your business more valuable and will often help your business make more money immediately. Check this guide to used machinery and equipment appraisal for more details.

10. How Much Competition Is There?

If you are in an industry that is low on supply and high on demand, you are in a good position. If your workers are uniquely skilled at manufacturing an in-demand product, your business's value could also increase.

11. The Age of Your Employees

If all of your employees are nearing retirement, your valuation may go down. Buyers want a business with skilled younger workers who will keep the business going for many years to come.

12. Procedures and Certifications

If you have taken the time to carefully detail all of the steps in your manufacturing process, your business's value will be higher. A written process means that it will be easy for your business to transition from one owner to another with little loss in production or revenue.

Any certifications you can get, such as

ISO for manufacturing

or

ISO 9001

can also give your manufacturing business's value a boost. These certifications mean you have been vetted and meet industry standards, again making for an easy transition and distinguishing you from your competition.

13. What Your Machines and Equipment Are Worth

If you have machines and other equipment that are worth a lot, you can get a higher asking price. A buyer will likely finance the sale, and a bank will need something for collateral. They will often use the company's equipment for collateral, and if it's not enough, a buyer will have to pay out of pocket. Thus, buyers like a business with expensive machinery.

It is also worth noting that you cannot add the

cost of your used equipment

to the asking price. Everything comes at one price.

14. The Ratio of Your Business's Earnings to the Buyer's Loan

As a buyer gets ready to take out a loan to finance their purchase, the bank will often look at what the business earns compared to what the buyer is financing. This ratio is called the DSCR (Debt Service Cover Ratio). It basically determines if the business earns enough to cover the buyer's loan. You want to value your manufacturing business within this ratio, otherwise, it may be difficult to sell.

15. Location, Location, Location

Your business's location plays a role in its valuation. If you're located in an area with factors that draw in both skilled employees and customers, such as a thriving town with good schools, good healthcare, etc., then you'll get more for your business.

Free Business Valuation Guide

Learn more about Business Valuation and why it matters the most while planning an M&A exit strategy.

What Is the Role of Manufacturing Business Brokers in Selling My Manufacturing Company?

You may be wondering how

mergers and acquisitions brokers

can help you with selling your manufacturing business. What is their role and what are you required to do? Below, we've detailed some of the top services your M&A Broker should provide.

Qualifying Potential Buyers

Your potential buyers can come from many areas. Employees, individual and group investors, Private Equity Groups, and even competitors may be interested in purchasing your business. If a competitor is interested, you do not want to reveal too much information about your business, especially anything that could be used against you if the deal falls through.

Once you decide to sell,

get your business ready, and get help from a trusted and

accredited M&A Advisor.

A manufacturing business broker will vet potential buyers to make sure they're legitimate and are serious about purchasing your business. An M&A Advisor knows the ins and outs of selling a manufacturing business and can help you get your business in shape to get you the best deal.

Manufacturing Business Broker Should Manage All of the Following Phases and Activities:

The following steps include everything an M&A Advisor should manage during the sale of your business. A manufacturing business broker will have a buying and selling a business checklist that can guide you through the process.

Exit Plan - The Best Path to Take to Sell a Business

One of the first things your mid market mergers and acquisitions broker will be to help you create an exit plan. An M&A broker knows exactly how to plan an M&A exit strategy. In fact, you might get an Advisor to help you with an exit plan long before you are ready to sell your manufacturing business.

An M&A Broker is knowledgeable about how to

calculate the value of a business

for sale and will aim to get the highest value for your business. Once everything is ready to go, they'll list your business for sale. A business manufacturing broker will be an expert at listing manufacturing businesses on the market.

After your business is listed, the

M&A Consultant

will handle all the marketing of your business to promote deal origination and get you in front of potential buyers. They'll also set a buyer list and work with you to figure out who to go after for the best value.

Deal Origination - Marketing the Deal

A lower middle market manufacturing business broker will then work to get you a lot of offers on your business. They'll market your business through the proper channels, including social selling and targeting and generating interest. They'll vet and follow up with interested buyers whether off-market or publicly listed. Once the offers come in, your M&A Broker will evaluate all offers and conduct market offer analysis to make sure you're getting the best deal.

Negotiation - Buyer Due Diligence

Once a buyer is performing their own due diligence, the business manufacturing Broker will help you navigate the process to make sure everything is running smoothly. They'll negotiate a Letter Of Intent between you and the buyer to lay out the proposed aspects of the deal. A M&A intermediary will also help you gather all of the necessary paperwork discussed above. If the buyer asks for additional documentation, your Business Intermediary can help you procure that.

As a buyer is going through the due diligence process, they'll be on the lookout for red flags about your business. An experienced Broker is knowledgeable about these warning signs and can help you prevent them. Red flags may include refusing to disclose why you're selling, not allowing time to conduct due diligence, refusal to introduce the buyer at the right time to suppliers, employees and landlords, and more.

Negotiation - Definitive Purchase Agreement

The M&A Broker will oversee the Definitive Purchase Agreement, making sure both parties are happy with the terms. A Definitive Purchase Agreement can protect both you and the buyer as it will clearly state exactly what is and is not being sold. It can also protect the buyer from certain liabilities. A Definitive Purchase Agreement can also help you deal with the legal complexities of selling a California manufacturing business.

Once the Definitive Purchase Agreement is finalized, the M&A Broker will help with any final details so the sale can prepare to close. They will then finalize the contract and make sure the terms are accurately represented, finance is in place and a closing escrow process is done.

Closing - Finalize the Transaction and Close the Deal

Finally, your M&A Consultant will finalize the transaction. They'll help you through the closing process. Once the closing is complete, they'll oversee the transition of the business so the seller and buyer are satisfied with the transaction.

Need help with valuing & selling your manufacturing business?

Rogerson Business Services (RBS Advisors) is an M&A Advisory Firm for lower middle market businesses built on trust and ethics. Andrew Rogerson, Certified M&A Advisor, can help you find answers to all your questions, introduce you to better opportunities, and manage the buying and selling a manufacturing company in California with process's integrity while keeping every aspect of sales confidential.

Mistakes to Avoid: Manufacturing Businesses for Sale in California

There are many mistakes you can make when selling your manufacturing business on your own. The worst of these mistakes are ones that make your business appear less valuable to buyers. You may wind up selling your business privately for a lot less than it's worth. Below are a few factors that may make a buyer think your business is worth less than it really is.

Your factory business can't be too dependent on one or even a few clients. You need diverse revenue streams. It can also be a problem if you do not have much cash flow. If you're spending everything you're making on debts and other obligations, your business won't be worth as much. If you don't have any recurring revenue that can be an issue as well.

There may also be issues in the way your business is structured. Your manufacturing business may be doing well, but if you don't have a growth strategy, you may be in trouble. A buyer wants a business that will continue to grow over time. You also want to be careful about becoming a commoditized business. You need to distinguish yourself in your industry so that customers are willing to pay a premium for the unique value you offer.

Avoiding These Pitfalls

If you want to avoid these pitfalls and many more that can devalue your business, consider using a broker so that you get the highest value for your manufacturing business. A manufacturing business broker is experienced in

selling manufacturing business

and can help you avoid these mistakes and more.

M&A LOWER MIDDLE MARKET ADVISORY

Why Work With RBS Advisors?

Business Valuation

Many sellers neglect the business valuation and methodology early in the process, only to become frustrated after the deal has been finalized. Rogerson Business Services, RBS Advisors, can help you understand the value of your business based on different methodologies.

Legal Due Diligence

When selling a business, the legal standing of the business determines the smoothness, efficiency, and speed at which the transaction is finalized. M&A Advisors offer a sell-side M&A process backed by the viability of a California Licensed business or transaction attorney. With a licensed California M&A Advisor, you can be certain the legal documents involved in the sell-side M&A process is detailed and accurate.

Business Analysis

To avoid wasting time with unqualified buyers, get help from a trusted, licensed, and accredited California M&A Advisor. An Advisor will vet potential buyers to make sure they're legitimate and are serious about purchasing your business. An M&A Advisor knows the ins and outs of selling a lower middle market business and can also help you get your business in shape to get you the best deal.

Financial Due Diligence

Our service includes deal team professionals to assist you. From financial to legal documents to tax and procedures, we want to make sure you are covered.

If you have your own in-house team of advisors, RBS Advisors can help make the M&A sell-side process as easy as possible by offering insights that help the team understand and are in alignment with the same goals as yours.

Definitive Purchase Agreement

The Definitive Purchase Agreement is usually extremely complex. It is easy to overlook all the terms and legal jargon, but every paragraph is important and duly considered. It is therefore critical to ask questions and ensure you are comfortable with the final set of legal documents you need to sign.

M&A Sell-Side Targeting

RBS Advisors provide Mergers & Acquisition Sell-Side Advisory. We zero target off-market, accretive, private equity and strategic buyers with an interest in lower to middle market companies or businesses to maximize incremental growth value.

Final Thoughts on Selling a CA Manufacturing Business

Whether you're ready to sell your business within the next year or within the next several years, it is a good idea to have an exit strategy in place. An exit strategy framework will ensure that you have everything ready to sell once the time comes.

While going through the process of selling your business, there are many intricacies to deal with. You may worry that you'll make an error, and rightly so. Errors can hold up or even stop a sale.

To ensure that everything runs smoothly, you may want to hire an RBS Advisor to make sure that you're doing everything correctly and aren't neglecting an important step. An Advisor will save you time and money and give you peace of mind that you're putting your business in good hands.

Do you have more questions that only an expert can answer? A commitment-free consultation with an RBS Advisor can offer insight without adding pressure to this big decision.

Need help maximizing your manufacturing business value before selling?

Rogerson Business Services (RBS Advisors) is an M&A Advisory Firm for lower middle market businesses built on trust and ethics. Andrew Rogerson, Certified M&A Advisor, can help you find answers to all your questions, introduce you to better opportunities, and manage the buying and selling a manufacturing company in California process's integrity while keeping every aspect of sales confidential.

FAQ's

Sell-Side M&A

Sell a Business

Business Valuation

Ten Reasons to Plan a Business Exit Strategy with

RBS Advisors

1. Ethics

RBS Advisors are members of the M&A Source, International Business Brokers Association (IBBA) and California Association of Business Brokers (CABB) and adhere to their code of ethics.

2. Confidentiality

RBS Advisors assist you professionally in a highly confidential manner to protect your personal and financial details.

3. Vetted businesses for sale

RBS Advisors have access to an inventory of businesses including unlisted businesses for sale in California.

4. Facilitator

RBS Advisors are specialists in business transitions and understand the need to respect all parties in the transaction. There are many steps to value, sell and buy a business. Rogerson Business Services have successfully navigated these steps many, many times.

5. Valuation

RBS Advisors can provide you an opinion of value of a business you wish to sell or buy.

6. Due diligence and escrow

RBS Advisors has the knowledge to work through leases, franchise agreements, finance requirements, licensing, California escrow requirement and many other items so the sale of a business is successful.

7. Negotiation

RBS Advisors practice win/win negotiation skills. Negotiations are rarely perfect and so a win/win approach is the best way forward.

8. Financing and funding

RBS Advisors has professional lenders that can assist with finance to successfully buy a business.

9. Resource

RBS Advisors is an active member in the associations of the M&A and Business Broker industry including M&A Source, the International Business Brokers Association (IBBA), California Association of Business Brokers (CABB), International Society of Business Appraisers (ISBA) as well as other professional organizations.

10. Closing and transfer

RBS Advisors works with you each step of the way. This includes managing the buying or selling of your business through initial negotiations, due diligence, escrow and the all-important closing.

We built this amazing step-by-step-guide to help "Sell a Manufacturing Company" - it is yours (free)

Rogerson Business Services provide Mergers & Acquisitions Sell-Side Advisory to lower middle market businesses in California. We zero target off-market, accretive, private equity and strategic byers in lower middle market companies to maximize incremental growth value.