Sell Commercial Property With Operating Business In California

Every successful commercial property sale requires three factors:

- Confidentiality: Protecting the business from disruptions and maintaining its value during the sale process.

- Licensing: California's strict licensing requirements for various businesses can limit the pool of qualified buyers.

- SBA loan complexities: Securing an SBA loan for the purchase adds time and complexity to the sale process.

Find out if we are a good fit by taking a 'quick self assessment quiz' to learn more about your business

You Are Now Ready To Sell Your Business With Commercial Property

Selling Your Biz with Your Bricks? Watch Out for These Bumps!

So, you're ready to cash out on your thriving business and its sweet commercial property? Hold on, partner! Selling both together might seem like a breeze, but there can be some hidden potholes in the road.

Don't worry, we've got your back with the key bumps to avoid:

Secret Squirrel Sale:

Imagine shouting "Selling my business!" from the rooftops. Customers flee, employees jump ship, and vendors ghost you faster than a tumbleweed in a Western. Yikes! That's why California keeps business sales under wraps. No blabbing allowed! This secrecy keeps your business humming and its value high while you navigate the sale.

License Limbo:

California loves its licenses, and some businesses need special ones to operate. Finding a buyer who fits your business and its permits can feel like searching for a unicorn – rare and takes time. So, be patient and prepared for some extra digging to find the perfect match.

Loan Sharknado:

Forget lemonade stands, businesses gotta deal with SBA loans or other complex financing process. This adds another layer to the selling frenzy, so buckle up for some paperwork and patience.

Commercial Property Detective Game:

Before you slap a "For Sale" sign on your property, channel your inner Sherlock Holmes! Check for hidden cracks, environmental gremlins, flood risks, and even neighborhood drama. Having all the dirt upfront makes the sale smoother and helps you fetch the top dollar.

Rent Roulette:

Is your rent super low? Don't expect the buyer to be your charity case. Be realistic about market rent and who's gonna foot the bill for property taxes, insurance, and upkeep after the sale.

Title Twister and Flood Friend:

Imagine selling your car only to find out it's actually a spaceship! Don't let that happen with your property. Get a proper land title survey and check if the property is chilling in a flood zone. These things can sink a sale faster than a leaky boat.

Escrow Escapade:

Think of escrow as your trusty guide through the selling maze. They'll hold onto your hard-earned cash and make sure everything is crossed off the checklist before you hand over the keys.

Remember, selling your business with your commercial property in California is like a rollercoaster – exciting, but with twists and turns. By keeping these points in mind, you can navigate the ride smoothly and land a sweet deal for both your business and your bricks!

Bonus Tip: Check out those free reports we mentioned. They're like X-ray glasses for your property, helping you spot any hidden nasties before they cause trouble.

Good luck!

Get Involved!

Check Out These Sample Reports

Get a Head Start on Selling Your California Commercial Property: Request Your Free Early Insights Report Sample!

Thinking of selling your California commercial property? Don't dive headfirst into the market without a roadmap. Uncover hidden opportunities and potential pitfalls early on with Rogerson Business Services' free Early Insights Report Sample.

Imagine:

- Knowing exactly what California real estate laws mean for your property's value and marketability.

- Identifying potential roadblocks before they derail your sale timeline.

- Gaining valuable insights into buyer preferences and market trends in your area.

Our Early Insights Report, based on a legal checklist, reveals:

- Zoning restrictions and redevelopment potential.

- Environmental liabilities and remediation costs.

- Title encumbrances and hidden liens.

- Compliance with ADA regulations and accessibility standards.

- Mandatory disclosures and potential tax implications.

- Tenant lease agreements and rent control considerations.

- Market trends and buyer preferences for similar properties.

With this knowledge, you can:

- Maximize your asking price by showcasing the property's true potential.

- Negotiate with confidence, knowing your legal rights and responsibilities.

- Attract qualified buyers and close the deal faster.

- Don't wait until it's too late! Request your free Early Insights Report Sample today and take control of your California commercial property's sale.

Simply click the button below and enter your email address to unlock your free sample:

Bonus: As a special thank you, you'll also receive our "Top 5 California Commercial Property Selling Mistakes to Avoid" checklist absolutely free!

Don't miss out on this valuable opportunity to gain a competitive edge! Get your Early Insights Report Sample now!

P.S. Share this offer with any California business owner you know who might be considering selling their commercial property.

They'll thank you for it!

Don't Let California's Climate Blindside Your Property Sale: Get Your Free Climate Check Report Sample!

Thinking of selling your California commercial property? Don't get caught off guard by the Golden State's hidden risks. Uncover potential vulnerabilities and unlock hidden value with Rogerson Business Services' free Climate Check Report Sample.

Imagine:

- Knowing exactly how California's climate and natural hazards impact your property's marketability and value.

- Identifying potential repair costs, insurance implications, and buyer concerns before they derail your sale.

- Demonstrating your proactiveness and commitment to sustainability, attracting responsible and informed buyers.

Our Climate Check Report, based on a comprehensive checklist, reveals:

- Microclimate analysis: Understand the unique climate challenges and opportunities specific to your property's location.

- Temperature extremes: Evaluate the potential impacts of heat waves, cold snaps, and energy costs on your property.

- Precipitation patterns: Assess flood risks, drought vulnerabilities, and water management needs.

- Earthquake zone proximity: Determine potential seismic risks and building code compliance requirements.

- Wildfire risk assessment: Analyze fire history, vegetation, and mitigation strategies for your property.

- Sea level rise impact: Understand potential coastal erosion, flooding, and infrastructure damage.

- Drought frequency and severity: Assess water availability and potential impacts on property value.

- Extreme weather event analysis: Anticipate the increased frequency of heat waves, storms, and other weather events.

With this knowledge, you can:

- Set a fair and informed asking price, avoiding underselling due to hidden risks.

- Negotiate with confidence, knowing your property's strengths and vulnerabilities.

- Attract responsible buyers who appreciate your commitment to sustainability and resilience.

- Market your property as "climate-conscious," standing out from the competition.

Don't wait until it's too late! Request your free Climate Check Report Sample today and gain a powerful advantage in your California commercial property sale.

Simply click the button below and enter your email address to unlock your free sample:

Bonus: As a special thank you, you'll also receive our "5 Steps to Making Your California Commercial Property Climate-Ready" checklist absolutely free!

Don't miss out on this valuable opportunity to gain a competitive edge! Get your Climate Check Report Sample now!

P.S. Share this offer with any California business owner you know who might be considering selling their commercial property.

They'll thank you for it!

Get a Glimpse of Your California Commercial Property's Value: Request Your Free Commercial Automated Valuation Model (CAVM) Report Sample!

Thinking of selling your California commercial property? Ditch the guesswork and gain valuable insights into its market potential with Rogerson Business Services' free commercial AVM Report Sample.

Imagine:

- Knowing the estimated market value of your property instantly gives you a powerful starting point for negotiations and pricing.

- Unveiling potential discrepancies between traditional appraisals and AVM results, empowering you to make informed decisions and optimize your strategy.

- Staying ahead of the curve with data-driven insights into current market trends and buyer preferences.

Our Commercial AVM Report, powered by cutting-edge technology, reveals:

- Comparable sales data: See recent sales of similar properties in your area, providing valuable context for your own valuation.

- Market trend analysis: Understand current supply and demand dynamics, economic factors, and investor sentiment.

- Rental rate and occupancy insights: Get a clear picture of potential income generation from existing or potential tenants.

- Zoning and development restrictions: Discover potential limitations and redevelopment opportunities impacting your property's value.

- Estimated property value range: Gain a realistic understanding of your property's market position, empowering confident decision-making.

With this knowledge at your fingertips, you can:

- Set a competitive and informed asking price, attracting serious buyers from the outset.

- Negotiate with confidence, backed by data-driven insights into your property's strengths and weaknesses.

- Market your property effectively, highlighting its value proposition to potential buyers.

- Save valuable time and resources compared to traditional appraisal methods.

Don't wait until it's too late! Request your free AVM Report Sample today and unlock the potential of your California commercial property!

Simply click the link below and enter your email address to unlock your free sample:

Bonus: As a special thank you, you'll also receive our "Top 5 Tips for Maximizing Your California Commercial Property's Market Value" checklist absolutely free!

Don't miss out on this valuable opportunity to gain a competitive edge! Get your AVM Report Sample now!

P.S. Share this offer with any California business owner you know who might be considering selling their commercial property.

They'll thank you for it!

Marketing The M&A Deal

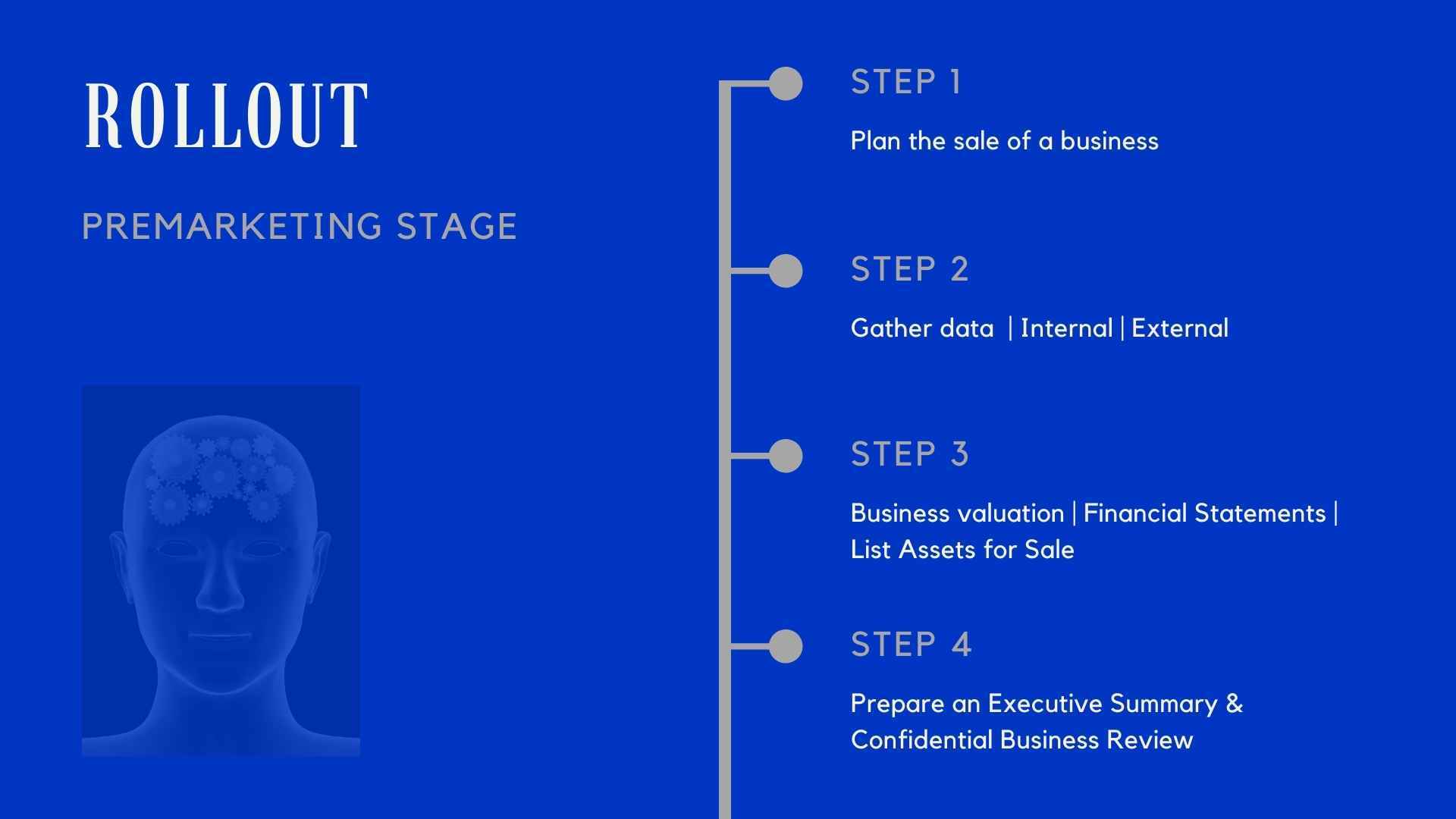

Getting Ready

This step includes taking the necessary preparations to allow the M&A process to run smoothly.

- Prepare non-disclosure agreements

- Create a confidential information memorandum (CIM)

- Organize finances

- Create projections of income to show potential buyers

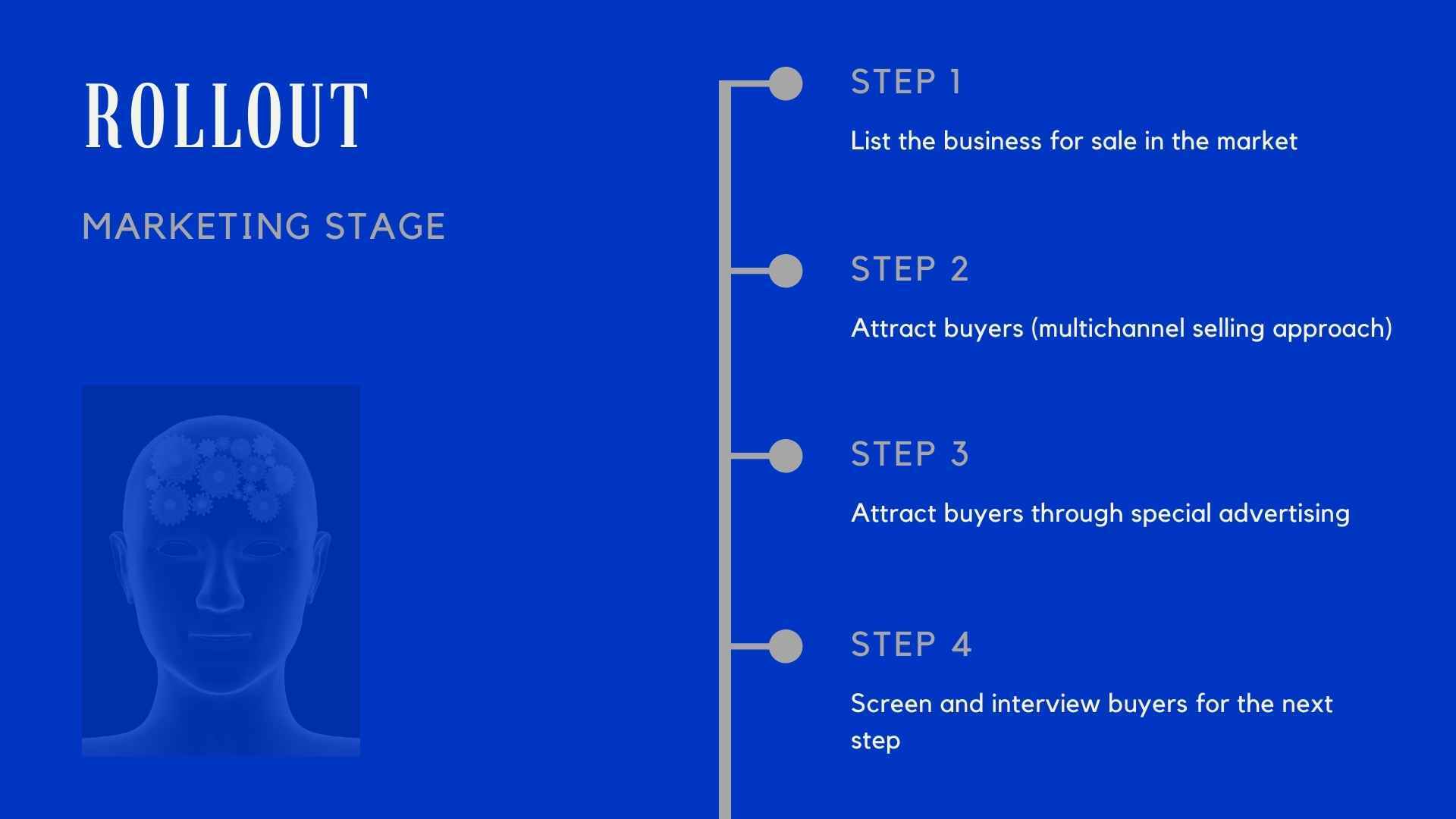

Round 1

4-6 weeks.

The first round is where the M&A process begins in earnest. Several steps should be accomplished during this time.

- Non-disclosure agreements exchanged

- CIM distributed to potential buyers

- Receive initial bids

It’s vital to note that while initial bids are non-binding, they can gauge a potential buyer’s interest.

Round 2

4-6 weeks.

Round 2 is when the seller will meet with interested buyers. Several things should occur during this time.

- Hold meetings with interested buyers

- Draft a definitive agreement

- Prepare a data room to facilitate due diligence

- Receive final bids from the buyers

Negotiations

4-6 weeks.

Negotiation is the final portion of the M&A process and the last step in selling a company. During this time, there are things to be finalized.

- Send the definitive agreement to buyers

- Enter an exclusivity agreement with a single buyer

- Present the buyer's terms to the board

- Receive board approval

- Sign the definitive agreement

Once the definitive agreement is signed, the M&A process is complete.

Digging Deeper: Beyond the Basics of Selling Your Business with Commercial Property

Selling a California lower middle market business with its commercial property can be a complex dance. While we covered the big moves in the above section, let's peek behind the curtain at some additional factors to consider:

Keeping Your Bricks & Mortar:

Not every California business owner in the lower middle market wants to say goodbye to their property. Some prefer to keep it and offer a lease to the buyer. This can be a win-win, especially if the property is crucial to the business operation (think gas stations and car washes!). But before you waltz down this path, ponder:

- Is it glued to the business? Can you easily separate them, or are they like peanut butter and jelly?

- Building Blues? Is your property a shining star or a fixer-upper? Are you ready to handle repairs or willing to pass the baton with a fresh coat of paint?

- Lease Length Limbo: What if your tenant takes an early exit? Can you find a new dance partner quickly, or will you be left with empty steps? Remember, SBA loans often require 10-year leases, so think long-term!

See a full list of selling a business questions by business owners that we've already answered with deeper details.

Rent:

Is your current rent a sweet melody or a discordant note? Be realistic about market rates and who'll pick up the tab for property taxes, insurance, and maintenance after the sale. Remember, low rent can lower the business value like a flat note in a symphony.

Environmental Encores:

Any environmental gremlins lurking around your property? These can throw a wrench in the whole performance, impacting both the business and real estate value.

Zoning Zoning, Who's Got the Zoning?

Before putting up the "For Sale" sign, ensure your property is in tune with local zoning ordinances. Think of it as checking the stage for hidden props that could delay or even sabotage the closing.

Flood Zone Foxtrot:

Is your property a potential flood victim? Knowing this early helps avoid a watery waltz when it comes to finding buyers.

Bonus Tip: Check those free reports we mentioned! They're your backstage crew, uncovering any hidden issues before the curtain rises on a smooth and successful sale.

- Sample report of California Commercial Real Estate property of the environment with regulatory summary and neighborhood.

- Sample report of California Commercial Real Estate with property condition report, site summary, building summary, hazard risks, and more.

- Sample report of California Commercial Real Estate flood certificate.

Remember, selling your business and commercial property is a journey, not a quick tango. By considering these additional factors, you'll be well-equipped to navigate the complexities and land a deal that's music to your ears!

M&A LOWER MIDDLE MARKET ADVISORY

Why Work With Rogerson Business Services?

Business Valuation

Many sellers neglect the business valuation and methodology early in the process, only to become frustrated after the deal has been finalized. Rogerson Business Services can help you understand the value of your business based on different methodologies.

Legal Due Diligence

When selling a business, the legal standing of the business determines the smoothness, efficiency, and speed at which the transaction is finalized. M&A Advisors offer a sell-side M&A process backed by the viability of a California Licensed business or transaction attorney. With a licensed California M&A Advisor, you can be certain the legal documents involved in the sell-side M&A process is detailed and accurate.

Business Analysis

To avoid wasting time with unqualified buyers, get help from a trusted, licensed, and accredited California M&A Advisor. An M&A Advisor will vet potential buyers to make sure they're legitimate and are serious about purchasing your business. An M&A Advisor knows the ins and outs of selling a lower middle market business and can also help you get your business in shape to get you the best deal.

Financial Due Diligence

Our service includes deal team professionals to assist you. From financial to legal documents to tax and procedures, we want to make sure you are covered.

If you have your own in-house team of advisors, Rogerson Business Services can help make the M&A sell-side process as easy as possible by offering insights that help the team understand and are in alignment with the same goals as yours.

Definitive Purchase Agreement

The Definitive Purchase Agreement is usually extremely complex. It is easy to overlook the all the terms and legal jargon, but every paragraph is important and duly considered. It is therefore critical to ask questions and ensure you are comfortable with the final set of legal documents you need to sign.

M&A Sell-Side Targeting

Rogerson Business Services provide Mergers & Acquisition M&A Sell-Side Advisory. We zero target off-market, accretive, private equity and strategic buyers with an interest in lower to middle market companies or businesses to maximize incremental growth value.

Interested in setting up a selling process plan?

Many retiring business owners looking to exit their business ownership, but without a selling process plan. This leaves the company to be valued less than it is expected. It is never too late to start on maximizing your business value.

What People Say About Rogerson Business Services

“Andrew was amazing and very knowledgeable. He completed a professional business evaluation for me, and I was very impressed with his detail, and the amount of work he put into it. It was definitely worth every penny. Even afterwards Andrew was willing to chat with me on the phone a number of times and answer follow up questions I had via email for no extra charge. All around he is a really nice guy, super professional, knowledgeable and from what I have seen the best in the business. He has many resources on his website that I also found to be very helpful. Thank you Andrew!”

Powers Roof Service

“Andrew was Great!! He was able to give us all the information we needed to make sure we made a wise decision on a huge financial decision and commitment!!”

Joseph Banegas Jr

“Mr. Rogerson performed a timely and thorough evaluation of our company. He was extremely helpful in explaining the various line items in the report and made sure I had a clear understanding of the conclusion. He is professional, friendly and very easy to work with. I would highly recommend his business services to anyone.”

Joe Gallegos

Rating

Rating

Reach out to any of our Deal Team & Advisors for a confidential conversation to see if we are a good fit.

We Help You Maximize The Value Of Your Business Before Selling it

Toll-Free

(844) 414-9600

5150 Fair Oaks Blvd, #101-198

Carmichael, CA, 95608

CA DRE# 01861204

Rogerson Business Services - Lower Middle Market Advisory

Read our Privacy Policy

Read our Accessibility Policy

M&A Knowledge Hub

THIS SITE IS DESIGNED AND POWERED BY INBOUNDEALZ