Successfully Sell And Exit My Business Ownership

Every successful business sale requires three factors:

- The business is well positioned and ready for sale in the market

- Deal origination and sourcing for qualified buyers

- Due diligence and closing the deal

Find out if we are a good fit by taking a 'quick self assessment quiz' to learn more about your business

You Are Now Ready To Sell Your Business

Retiring business owners, if you're looking to make a successful exit from the ownership of your business, it's important to be aware that only 2 out of 10 listed businesses in the United States will successfully get sold. That's a meager 20% success rate. However, this statistic can be improved with some well-thought-out preparation for sale and exit. To give yourself the best chance of selling and exiting your business in California, you'll need to groom the business ahead of time by getting it into shape for potential buyers.

At Rogerson Business Services, we specialize in helping retiring business owners like yourself through the journey of successfully selling and exiting their businesses. Our M&A Team will provide all the guidance and resources necessary to ensure you have a smooth transition as you go on to enjoy your life after sale. We understand that selling a business is not an easy process and varies depending on the industry you are in; that's why our services are tailored to meet each individual's needs, providing steps such as developing an effective sales strategy, managing customer relationships during the sale process, preparing financial and legal documents required by prospective buyers and much more.

We put in place strategies to help maximize value so that when it comes time for a sale - whether it’s next month or two years from now - you’ll walk away with what your business is worth. Our goal is for every client to feel confident about their decision when making such an important move – after all, this will likely be one of the most significant events in your entire life!

There is no need to feel overwhelmed or anxious about successfully selling and exiting your lower middle market business here in California - just reach out and fill out this assessment quiz today so we can start working towards achieving your goals!

If you are considering selling your commercial property with operating business in California, continue the journey by clicking here.

Here is a walkthrough of the steps we take with you till you sell and exit your business smoothly in California.

The First Step Starts With A Sell-Side Mandate

Now that you know how much your business is worth, it's time to get serious about successfully exiting and selling your venture.

A qualified M&A advisor can help guide you through the entire process, from searching for potential qualified buyers to finalizing the deal.

An M&A deal team should aim to achieve the best possible sale price for you – so don't be afraid to put forth aggressive valuations and assumptions.

The prospected qualified buyer in charge of due diligence will need to perform a thorough investigation of all relevant facts before finalizing the agreement - but with a reliable sell-side advisor at your side, navigating this phase should be relatively straightforward.

Retiring business owners in California: If you're looking to transition away from your company and ensure that you get the highest return on investment, then now's the time to start taking important steps towards the successful sale and exit of your business.

You don't have to do it alone – get professional advice and support every step of the way so that you can rest easy knowing that everything is being handled with utmost confidentiality and care.

Get started down this path today and make sure you reap all the rewards of your hard work.

The Sell-Side Process Begins When Qualified Buyers Show Interest In Your Business

The second step of the sell-side process will either be if a qualified buyer comes to you or if you decide to take action and initiate the sale.

From here, there are four options you can choose from for selling your lower middle market business: a broad auction, limited auction, targeted auction, and exclusive negotiation.

A broad auction is when your business is put up for sale with all potential buyers having access to information about it. With this type of sale, buyers will put in bids and offers that the seller can then review and negotiate before deciding on an offer they want to accept.

A limited auction limits the potential buyers who have access to information about your business. You would provide information only to pre-identified buyers that are likely interested in acquiring your business.

With a targeted auction, you target a specific group of potential buyers who are given information about your company and asked to submit offers or bids.

Lastly, an exclusive negotiation allows you to pick one buyer and use them as an exclusive channel for negotiating terms that both parties agree upon.

Now it's time for you to get started on successfully selling and exiting your lower middle market business in California so that you can enjoy life after retirement as much as possible.

Don't let this opportunity pass by – get an experienced M&A advisor by your side today who will help guide and advise you every step of the way!

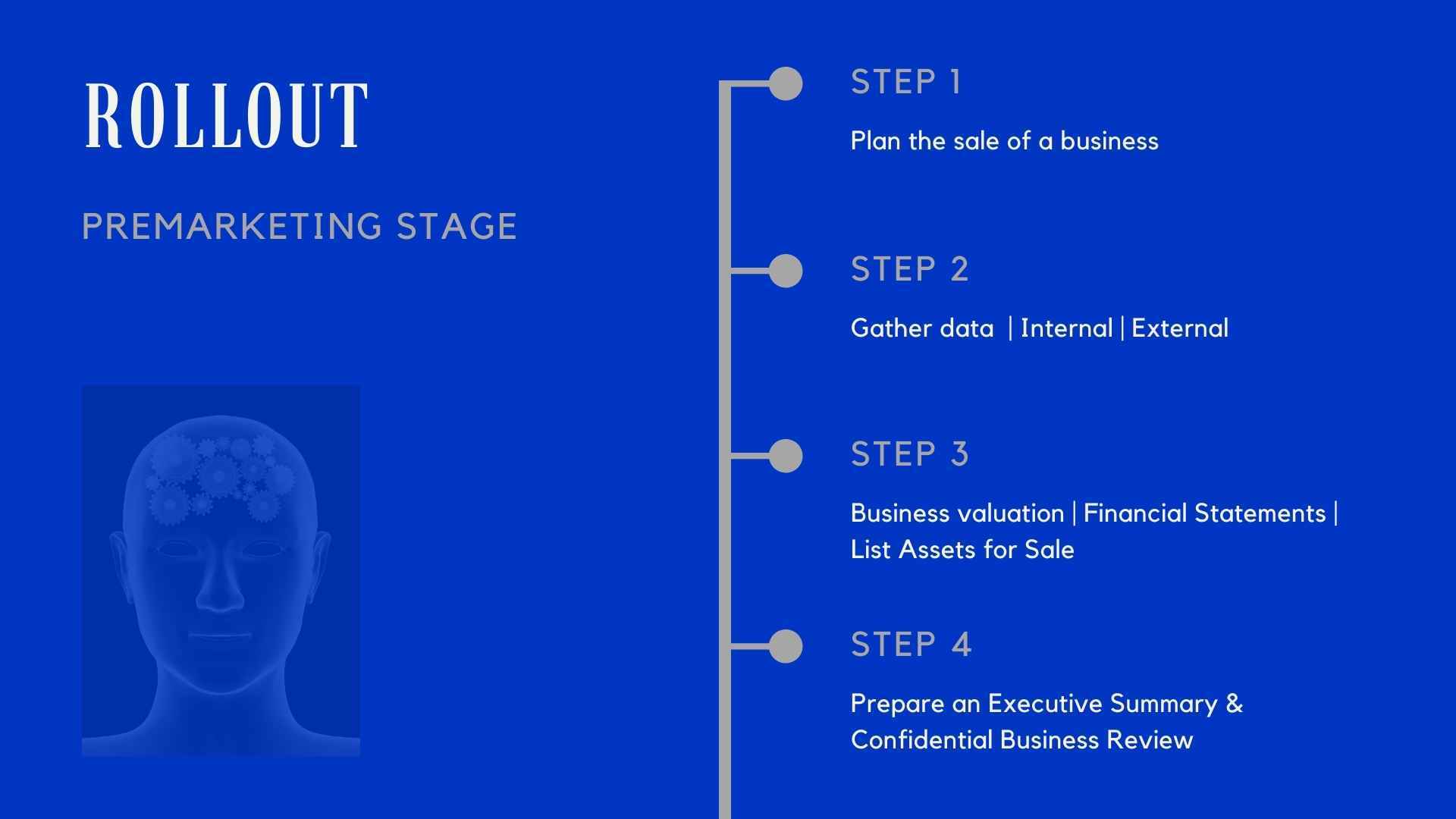

Preparing To Sell - Define A strategy

As a retiring business owner, you may be wondering what the next steps are to successfully sell and exit your lower middle market business in California.

The third step is to define your strategy. You will need to make several important decisions that will lay the foundation for the Mergers & Acquisitions (M&A) process.

These decisions include: deciding whether or not you want to sell, identifying potential buyers, creating a valuation framework, and setting a selling process and timeframe.

It is essential that you educate yourself about the M&A process so that you can make informed choices when it comes time to sell your business.

That's why having an experienced deal team of advisors by your side can be extremely beneficial - they can provide guidance and advice on how best to maximize value throughout the entire process.

It's also important to understand any potential legal issues related to selling your business, so it would be wise to seek out the services of a qualified lawyer who is well-versed in dealing with such matters.

Ultimately, successful M&A transactions involve both parties coming away with a mutually beneficial outcome - this means that their needs to be open communication between all parties involved as well as plenty of research on both sides of the table if things are going to go smoothly.

Once you have thoroughly investigated all options available, then it's time for you to begin actively searching for buyers who fit within your criteria and develop a timeline accordingly - this could range anywhere from one month up until six months or even longer depending on your individual needs and situation.

When it comes down to it, deciding when and how to exit your lower middle market business in California can be a daunting task but having the right team of advisors by your side makes all the difference - get started today with successfully selling and exiting yours for maximum return!

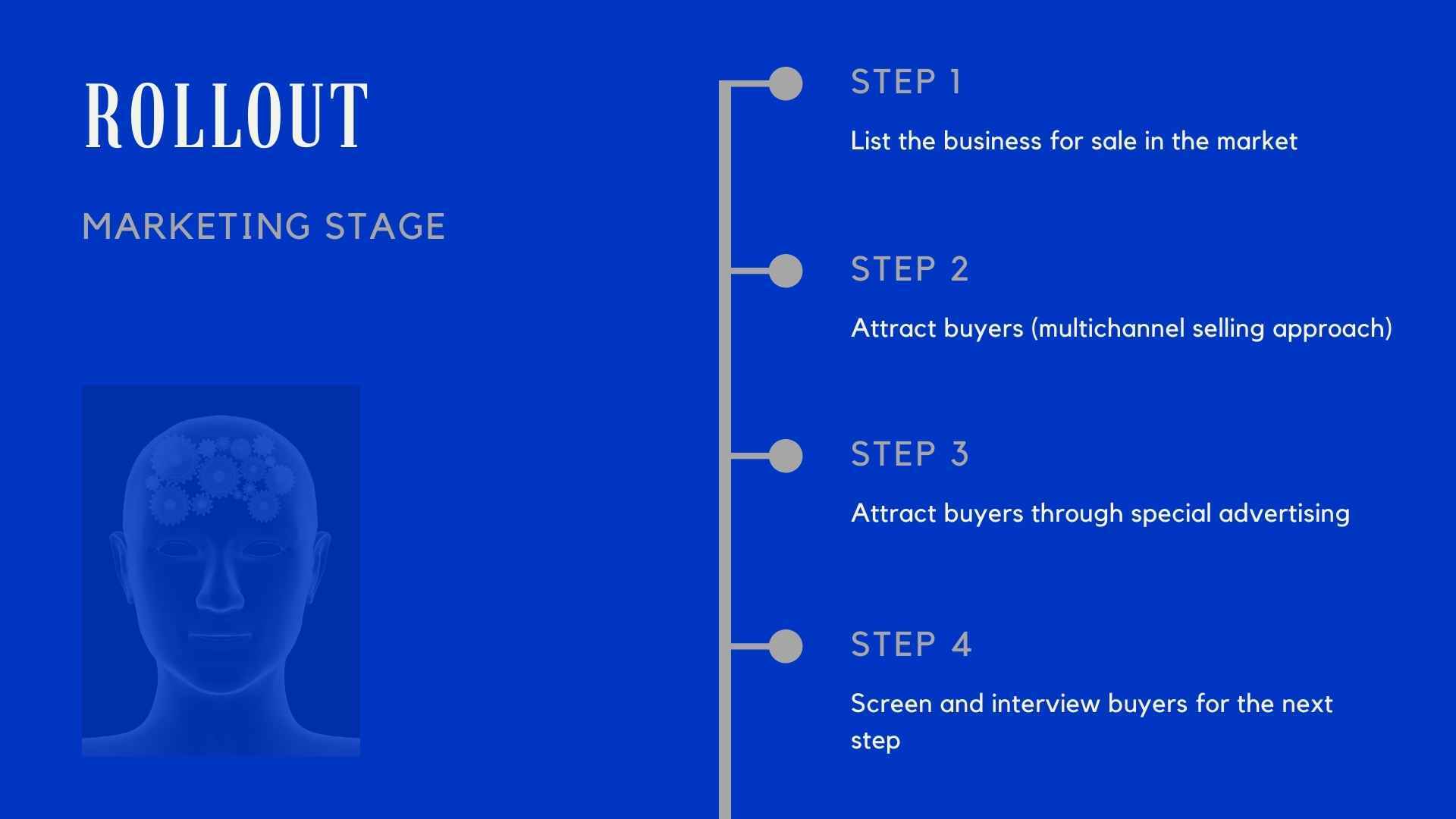

Marketing The Deal - Getting Ready

As business owner in California and looking to successfully sell and exit your lower middle market business, the next step is taking the necessary preparations to ensure the M&A process runs smoothly.

This includes preparing non-disclosure agreements, creating a confidential information memorandum (CIM) that outlines all relevant aspects of your business, organizing extensive financial records, and preparing projections of income that potential buyers can examine.

Organizing these documents can be time-consuming; however, it's essential for a successful sale.

Without accurate records, both parties may lack trust in each other or there may be confusion about the value of the company.

Put together financials that show profitability over several years and market research on comparable businesses that have sold recently. Doing so can help show potential buyers why your company is valuable and why it's worth what you're asking for it.

Finally, be sure to take into consideration how long you are willing to wait for a buyer.

Depending on the size of your business and its location, some sales could take months while others could take upwards of two years or more.

The more prepared you are when beginning this process, the faster and smoother it will go — plus you'll have peace of mind knowing that everything has been taken care of properly. So don't delay any longer — start today on successfully selling and exiting your lower middle market business in California!

Marketing The M&A Deal

Getting Ready

This step includes taking the necessary preparations to allow the M&A process to run smoothly.

- Prepare non-disclosure agreements

- Create a confidential information memorandum (CIM)

- Organize finances

- Create projections of income to show potential buyers

Round 1

4-6 weeks.

The first round is where the M&A process begins in earnest. Several steps should be accomplished during this time.

- Non-disclosure agreements exchanged

- CIM distributed to potential buyers

- Receive initial bids

It’s vital to note that while initial bids are non-binding, they can gauge a potential buyer’s interest.

Round 2

4-6 weeks.

Round 2 is when the seller will meet with interested buyers. Several things should occur during this time.

- Hold meetings with interested buyers

- Draft a definitive agreement

- Prepare a data room to facilitate due diligence

- Receive final bids from the buyers

Negotiations

4-6 weeks.

Negotiation is the final portion of the M&A process and the last step in selling a company. During this time, there are things to be finalized.

- Send the definitive agreement to buyers

- Enter an exclusivity agreement with a single buyer

- Present the buyer's terms to the board

- Receive board approval

- Sign the definitive agreement

Once the definitive agreement is signed, the M&A process is complete.

Rogerson Business Services

Business Assessment Report

How To Get Started

Fill in the form

Complete the questionnaire so we know some basic details about your company, and get a detailed understanding of what you're looking for.

Get an invite for a call

Once you submit your form, we will invite you within a 24 hours period to schedule a call on Calendly so you get to pick the best time that works for you.

Bring your questions

Tell us more about your background, what are your pain points, have you thought of selling your business, do you want to know how much does your business is worth, do you want to know about taxes and their implications, are you curios about a transition plan, and many more that you can bring along the 30 minute call.

Get a customized plan

Our deal experts will review all the information you submit in order to create a plan that works with achieving your goals and needs.

Interested in setting up a selling process plan?

Many retiring business owners looking to exit their business ownership, but without a selling process plan. This leaves the company to be valued less than it is expected. It is never too late to start on maximizing your business value.

M&A LOWER MIDDLE MARKET ADVISORY

Why Work With Rogerson Business Services?

Business Valuation

Many sellers neglect the business valuation and methodology early in the process, only to become frustrated after the deal has been finalized. Rogerson Business Services can help you understand the value of your business based on different methodologies.

Legal Due Diligence

When selling a business, the legal standing of the business determines the smoothness, efficiency, and speed at which the transaction is finalized. M&A Advisors offer a sell-side M&A process backed by the viability of a California Licensed business or transaction attorney. With a licensed California M&A Advisor, you can be certain the legal documents involved in the sell-side M&A process is detailed and accurate.

Business Analysis

To avoid wasting time with unqualified buyers, get help from a trusted, licensed, and accredited California M&A Advisor. An M&A Advisor will vet potential buyers to make sure they're legitimate and are serious about purchasing your business. An M&A Advisor knows the ins and outs of selling a lower middle market business and can also help you get your business in shape to get you the best deal.

Financial Due Diligence

Our service includes deal team professionals to assist you. From financial to legal documents to tax and procedures, we want to make sure you are covered.

If you have your own in-house team of advisors, Rogerson Business Services can help make the M&A sell-side process as easy as possible by offering insights that help the team understand and are in alignment with the same goals as yours.

Definitive Purchase Agreement

The Definitive Purchase Agreement is usually extremely complex. It is easy to overlook the all the terms and legal jargon, but every paragraph is important and duly considered. It is therefore critical to ask questions and ensure you are comfortable with the final set of legal documents you need to sign.

M&A Sell-Side Targeting

Rogerson Business Services provide Mergers & Acquisition M&A Sell-Side Advisory. We zero target off-market, accretive, private equity and strategic buyers with an interest in lower to middle market companies or businesses to maximize incremental growth value.

Ten Reasons to Plan a Business Exit Strategy with

Rogerson Business Services

1. Ethics

Rogerson Business Services are members of the M&A Source, International Business Brokers Association (IBBA) and California Association of Business Brokers (CABB) and adhere to their code of ethics.

2. Confidentiality

Rogerson Business Services assists you professionally in a highly confidential manner to protect your personal and financial details.

3. Vetted businesses for sale

Rogerson Business Services have access to an inventory of businesses including unlisted businesses for sale in California.

4. Facilitator

Rogerson Business Services are specialists in business transitions and understand the need to respect all parties in the transaction. There are many steps to value, sell and buy a business. Rogerson Business Services have successfully navigated these steps many, many times.

5. Valuation

Rogerson Business Services can provide you an opinion of value of a business you wish to sell or buy.

6. Due diligence and escrow

Rogerson Business Services has the knowledge to work through leases, franchise agreements, finance requirements, licensing, California escrow requirement and many other items so the sale of a business is successful.

7. Negotiation

Rogerson Business Services practice win/win negotiation skills. Negotiations are rarely perfect and so a win/win approach is the best way forward.

8. Financing and funding

Rogerson Business Services has professional lenders that can assist with finance to successfully buy a business.

9. Resource

Rogerson Business Services is an active member in the associations of the M&A and Business Broker industry including M&A Source, the International Business Brokers Association (IBBA), California Association of Business Brokers (CABB), International Society of Business Appraisers (ISBA) as well as other professional organizations.

10. Closing and transfer

Rogerson Business Services works with you each step of the way. This includes managing the buying or selling of your business through initial negotiations, due diligence, escrow and the all-important closing.

What People Say About Rogerson Business Services

“Andrew was amazing and very knowledgeable. He completed a professional business evaluation for me, and I was very impressed with his detail, and the amount of work he put into it. It was definitely worth every penny. Even afterwards Andrew was willing to chat with me on the phone a number of times and answer follow up questions I had via email for no extra charge. All around he is a really nice guy, super professional, knowledgeable and from what I have seen the best in the business. He has many resources on his website that I also found to be very helpful. Thank you Andrew!”

Powers Roof Service

“Andrew was Great!! He was able to give us all the information we needed to make sure we made a wise decision on a huge financial decision and commitment!!”

Joseph Banegas Jr

“Mr. Rogerson performed a timely and thorough evaluation of our company. He was extremely helpful in explaining the various line items in the report and made sure I had a clear understanding of the conclusion. He is professional, friendly and very easy to work with. I would highly recommend his business services to anyone.”

Joe Gallegos

Rating

Rating

Selling A Business Checklist

Are you ready to retire and sell your business in California? Our comprehensive selling-a-business checklist is essential to ensure that you make it through the process smoothly and successfully. Everything you need to get started is right here – all you have to do is fill out the simple form and download the checklist.

This carefully tailored checklist has been designed specifically for baby boomer business owners, just like you. It contains important information on the key steps of selling a business, such as preparing financial documents, scouting potential buyers, negotiating offers, understanding tax implications, and more. So if peace of mind (and being well prepared) is important to you, this checklist is a must-have tool.

The best part about this list? It's easy to use and made by experts who have experience in the specific nuances of selling businesses in California – so no matter what stage of the process you are in, it will provide guidance on how best to navigate those tricky waters. Don't leave your future up to chance – take control now with our helpful checklist!

Download Checklist

Speed Up Your Exit Success!

Selling a Business Checklist Download Form

We will get back to you as soon as possible

Please try again later

Reach out to any of our Deal Team & Advisors for a confidential conversation to see if we are a good fit.

We Help You Maximize The Value Of Your Business Before Selling it

Toll-Free

(844) 414-9600

5150 Fair Oaks Blvd, #101-198

Carmichael, CA, 95608

CA DRE# 01861204

Rogerson Business Services - Lower Middle Market Advisory

Read our Privacy Policy

Read our Accessibility Policy

M&A Knowledge Hub

THIS SITE IS DESIGNED AND POWERED BY INBOUNDEALZ