How to Find a Manufacturing Business For Sale in California?

Tips to Find a Manufacturing Business for Sale

- Tip One: Find a manufacturing business broker

- Tip Two: What traits to look for in a Certified M&A Advisor

- Tip Three: Questions to ask a manufacturing business broker

- Tip Four: How a manufacturing business broker can help

- Tip Five:

Benefits of having a manufacturing business broker

As an investor or strategic buyer, you want to have all your money invested in a healthy manufacturing business with great potential for growth. Having an M&A Advisor, also known as a manufacturing business broker on your side will help you find the right manufacturing business for sale based on the financial and growth criteria that you set for the deal.

Are you looking to buy a manufacturing business for sale in California? Here are 5 tips to get you started.

One: Find a Manufacturing Business Broker

The first step is to find a qualified business broker to add to your deal team. Here are 3 ways to search and find a certified broker in California.

Referral Sources

Utilize a trusted network of business professionals made up of legal, finance, and consultants that can get you ahead in your search. Having a referral source working with you, is a great way to get started finding a qualified business intermediary that you can work with on the M&A buy-side deals.

Reach Out to Business Brokers Associations

There are many business brokers associations that you can reach out to and conduct a search based on geographic criteria and expertise. For example, the IBBA, International Business Brokers Association, is a non-profit organization that has over 1000 certified and qualified business brokers in its database.

You can also find a business broker focused on associations based on a region or a state. If you want to find a certified business broker in California, you can go directly to

CABB, California Association Business Brokers, and get started.

For bigger deals starting from lower middle market to mid-market businesses, you can get started by finding a certified mergers and acquisitions broker, also known as, M&A Advisor to help you with business acquisitions and sales. The difference between a business broker and an M&A Advisor is the deal size.

The bigger the deal size, the bigger the deal complexity to manage. For manufacturing business for sale in the mid-market business category, get started with the

M&A Source, a non-profit association

that works specifically with certified M&A advisors in the low middle-market segment.

Business Listing Marketplaces

The are many business listing marketplaces that you can reach out to and search for a qualified broker in the area and business category that you are interested in. However, there are many average brokers out there and a lot of them are advertised on those sites.

We recommend the below list for best results in finding a qualified manufacturing business broker in California.

Two: Traits of a Certified Merger and Acquisition Broker

Now you have found a list of qualified brokers, but how to Choose the right M&A Advisor is critical to successfully find and acquire the right manufacturing business for sale in California.

Here are some traits to look for when qualified an advisor to hire managing the

buyer due diligence

in an M&A

Deal.

Reputation

It is important to investigate the reputation and integrity of the M&A Advisor. Find out how are they being rated on the web, do they have a solid digital footprint, are there any negative reviews, and any indication that can signal a problem that you don’t want on your deal.

Network

Find out the strength of the Merger and Acquisition's broker network. Does the advisor has a deal team made up of qualified professionals in legal, finance, taxation, and industry experts?

Expertise

Is the qualified merger and acquisition advisor sold a manufacturing business before? It is very important that the broker is knowledgeable about business acquisitions and sales in the manufacturing industry and mainly in the state of California.

Track Record

Ask for the contact number of a Manufacturing business owner with a company in California, that the M&A Advisor has previously sold their business. Also, ask for the contact number of the buyer who acquired and bought a manufacturing business for sale.

If the M&A broker is unable to provide a contact number, due to confidentiality reasons, a safe way is to ask for a

real case study

made on the sale or transaction.

Most certified M&A Advisors do have case studies on file ready to reveal when needed.

Three: Questions to Ask a Certified Mergers & Acquisitions Broker

To further minimize your selection in choosing an advisor to help buy a manufacturing business or work on exit planning to help navigate through this challenging buy and sell-side M&A process is a big process. These questions should help out in short-listing the best candidate for the job.

- What is your experience in selling a manufacturing business in California?

- How do you package the manufacturing business for sale?

- How do you work with business acquisition buyers and investors?

- How do you value a manufacturing business that is for sale?

- How do you price a business for sale?

- How do you conduct buy-side due diligence?

- How do you conduct sell-side due diligence?

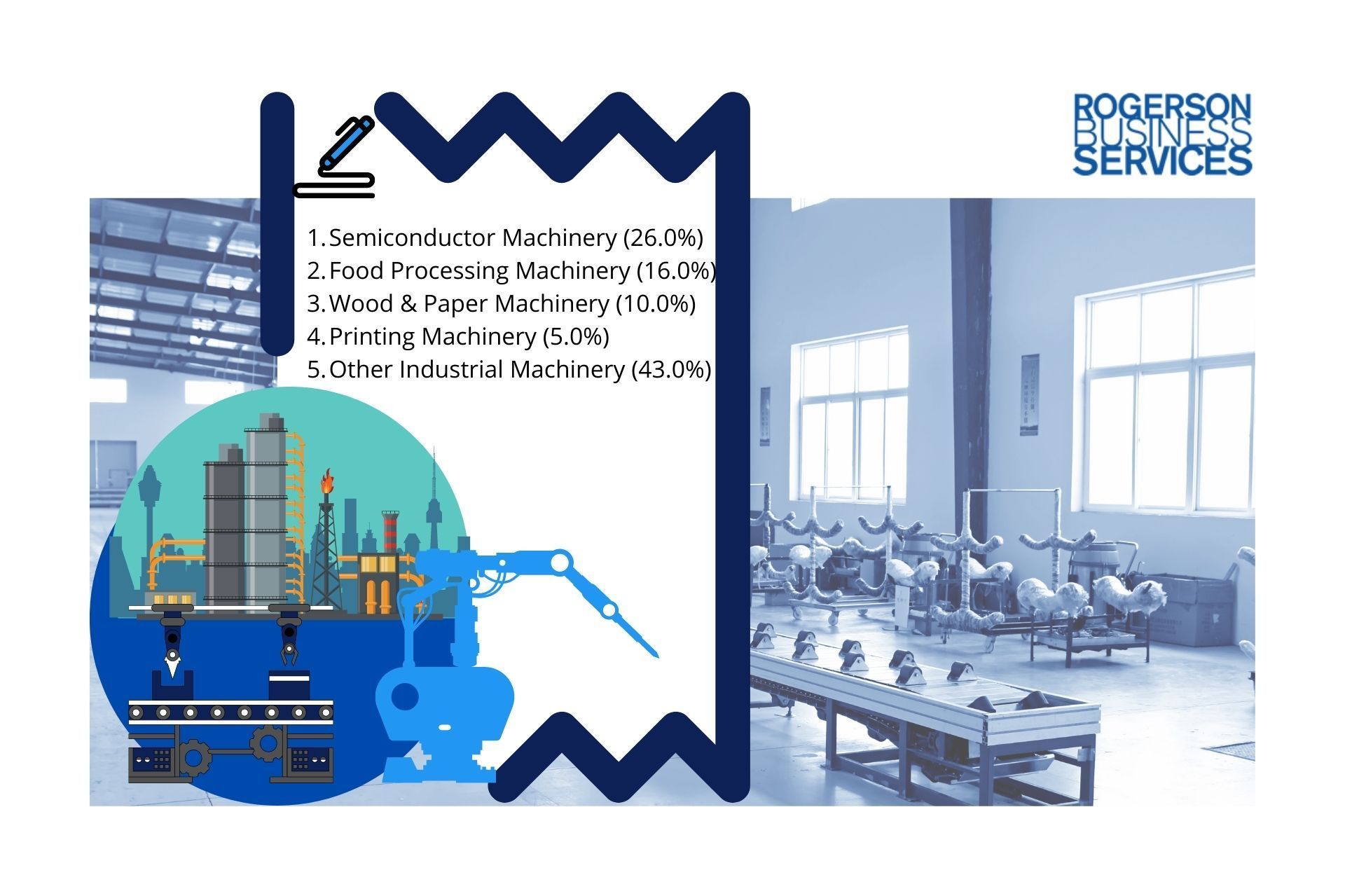

- What do you know about the current manufacturing industry in California?

- How many hats do you wear in the world of business acquisitions and sales?

Four: How a Manufacturing Business Broker Can Help

A strong acquisition team means having professionals interested in helping you make the best buying decision. If you are looking to buy a lower middle-market manufacturing business, having an M&A Advisor to lead your team is the best option.

An M&A Advisor should wear many hats to help buyers successfully find and acquire a California Manufacturing business with great potential for growth.

A qualified M&A Advisor acts as a matchmaker between a manufacturer owner who is looking to sell and interested strategic buyers or private equity investors.

A good

manufacturing business broker, handles every aspect of the deal, from

prospecting for potential buyers

to the final negotiation. However, buying a manufacturing business in the

lower middle market business

category with a deal size valuation between $5 to $50 million comes with much more complexity than buying a small business that is valued at $500k to $2m.

Five: Benefits of Working With a Manufacturing Business Broker

Various issues can occur with buyers who use the growth through acquisition strategy, and it's the broker’s job to ensure they don't arise. Some of the most common problems with acquiring a new manufacturing company include:

- Lack of due diligence

- Incorrect business alignments

- Rocky transitions

- Issues with employees and management

Employees, vendors, and suppliers are among the most valuable assets when purchases a manufacturing business. However, these business resources and other factors are often cautious of new management and the concept of

growth through acquisitions.

For this reason, it's helpful to work with a

Certified M&A Advisor

so they can help smooth this transition and finalize the acquisition.

Final Take

Deciding on acquiring a manufacturing business for sale on your own is a big risk, but it is possible if you arm yourself with the right deal team. Needless to say, the above provides helpful tips to find the right manufacturing business for sale and can lead to a successful merger and acquisition in the Manufacturing industry sector.

RBS Advisors

works closely with manufacturing business owners who wish to sell and exit their business mostly for retirement are the best acquisition types.

If you are interested to navigate through the process of buying a manufacturing business for sale in California,

get started here.

More Tips to Help Acquire a Lower Middle Market Manufacturing Company in California

Have Questions? We've Got Answers

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.