What are the Closing Documents for the Sale of a Business in California

What are the Closing Documents for the Sale of a Business in California

Are you closing a business sale in California? This guide provides a comprehensive overview of the essential closing documents required for a smooth and successful transaction.

The closing process marks the culmination of a business sale transaction, where ownership is officially transferred from the seller to the buyer. In California, this process involves a specific set of closing documents that are crucial for ensuring a legally sound and seamless transition.

This article provides a detailed overview of the essential closing documents for selling a business in California. It will equip you with the knowledge and resources to navigate this critical stage of a business sale documents confidently.

Key Takeaways:

- Bill of Sale is essential: This document formally transfers ownership of the business assets to the buyer.

- Deed of Transfer for real estate: If real estate is involved, a Deed of Transfer is necessary to convey ownership.

- Closing Statements provide clarity: These statements outline the financial details of the transaction for both parties.

- Additional documents may be needed: Depending on the specifics of the deal, additional documents like non-compete agreements or transition service agreements may be required.

- Legal counsel is crucial: Engage an experienced attorney to review all closing documents and ensure a legally sound transaction.

Bill of Sale

The Bill of Sale is a fundamental document in the closing process. It serves as legal proof of the transfer of ownership of the business assets from the seller to the buyer.

- Key Information:

- Names and addresses of the buyer and seller.

- Detailed description of the assets being sold.

- Purchase price and payment terms.

- Date of the transfer.

- Signatures of both parties.

Sample Bill of Sale (California Specific)

Bill of Sale

This Bill of Sale (the "Agreement") is made and entered into as of [DATE] by and between [SELLER NAME], residing at [SELLER ADDRESS] ("Seller") and [BUYER NAME], residing at [BUYER ADDRESS] ("Buyer").

1. Purchase and Sale. Seller hereby agrees to sell, transfer, and convey to Buyer, and Buyer hereby agrees to purchase from Seller, free and clear of all liens, encumbrances, and other charges, the following described property (the "Property"):

[Insert a detailed description of the property being sold, including any identifying information such as serial numbers, VINs, or other unique identifiers.]

2. Purchase Price. The purchase price for the Property is [AMOUNT] (the "Purchase Price"), payable as follows:

[Describe the payment terms, including any deposit, financing arrangements, or installment payments.]

3. Delivery and Acceptance. Seller shall deliver the Property to Buyer on or before [DATE] at [LOCATION]. Buyer shall have the right to inspect the Property prior to acceptance. Upon acceptance, Buyer shall be responsible for all risk of loss or damage to the Property.

4. Warranties. Seller warrants that:

- Seller is the lawful owner of the Property and has the right to sell and transfer it to Buyer.

- The Property is free and clear of all liens, encumbrances, and other charges.

- The Property is in good working condition and free from defects, except as otherwise disclosed in writing.

5. Disclaimers. EXCEPT AS EXPRESSLY PROVIDED IN THIS AGREEMENT, SELLER MAKES NO OTHER WARRANTIES, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

6. Indemnification. Seller shall indemnify and hold Buyer harmless from and against any and all claims, losses, damages, liabilities, costs, and expenses (including attorneys' fees) arising out of or relating to any breach of Seller's warranties or representations hereunder.

7. Entire Agreement. This Agreement constitutes the entire agreement and understanding between the parties with respect to the subject1 matter hereof and supersedes all prior or contemporaneous communications, representations, or agreements, whether oral or written.

8. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of California.

9. Notices. All notices and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered personally, upon the first business day following deposit in the United States mail, postage prepaid, certified or registered, return receipt requested, addressed as follows:

If to Seller:

[SELLER NAME]

[SELLER ADDRESS]

If to Buyer:

[BUYER NAME]

[BUYER ADDRESS]

or to such other address as either party may designate in writing from time to time.

10. Waiver. No waiver of any provision of this Agreement shall be effective unless in writing and signed by the waiving party.

11. Severability. If any provision of this Agreement is held to be invalid or unenforceable, such provision shall be struck from this Agreement and the remaining provisions shall5 remain in full force and effect.

12. Binding Effect. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, successors, and permitted assigns.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

[SELLER SIGNATURE]

[BUYER SIGNATURE]

Deed of Transfer

If the sale of the business includes real estate, such as the business premises or land, a Deed of Transfer is required to legally convey ownership from the seller to the buyer.

- Recording the Deed: The Deed of Transfer must be recorded with the County Recorder's Office to officially transfer the title of the property. This process typically involves submitting the deed along with the required fees and any necessary supporting documentation.

Closing Statements

Closing statements provide a detailed breakdown of the financial aspects of the transaction for both the buyer and the seller.

- Key Components:

- Purchase price.

- Escrow fees.

- Prorated property taxes.

- Closing costs (including title insurance, recording fees, attorney fees, etc.).

- Any adjustments or credits.

Other Closing Documents (Deep Dive)

Depending on the specific nature of the business and the terms of the sale, additional closing documents may be required.

- Non-Compete Agreements: Prevents the seller from competing with the business for a specified period in a defined geographic area.

- Employment Agreements: If key employees are staying on with the new owner, employment agreements may be necessary to outline the terms of their continued employment.

- Transition Services Agreements: Outlines any ongoing support or services the seller will provide to the buyer during the transition period, such as training, customer introductions, or access to key systems.

- Promissory Notes: If seller financing is involved, a promissory note will outline the terms of the loan, including the principal amount, interest rate, and repayment schedule.

- Security Agreements: If assets are used as collateral for financing, a security agreement will grant the lender a security interest in those assets.

- Release of Liens: If there are any liens on the business assets, such as loans or tax liens, a release of liens will need to be obtained to ensure a clear title to the assets.

- Non-Disparagement Agreements: To prevent negative comments or actions that could harm the business's reputation after the sale is closed.

Common Closing Challenges and Solutions

- Last-minute negotiations: Be prepared for potential last-minute negotiations or requests from the buyer. Maintain open communication and seek legal counsel if necessary to resolve any issues.

- Funding delays: If financing is delayed, work with the buyer and the lender to identify the cause of the delay and find solutions to expedite the process.

- Disagreements over closing costs: If disputes arise over closing costs, review the purchase agreement and any relevant documentation to determine the agreed-upon allocation of expenses.

- Post-closing transition issues: To ensure a smooth handover, clearly define the seller's responsibilities during the transition period and establish a communication plan to address any issues that may arise.

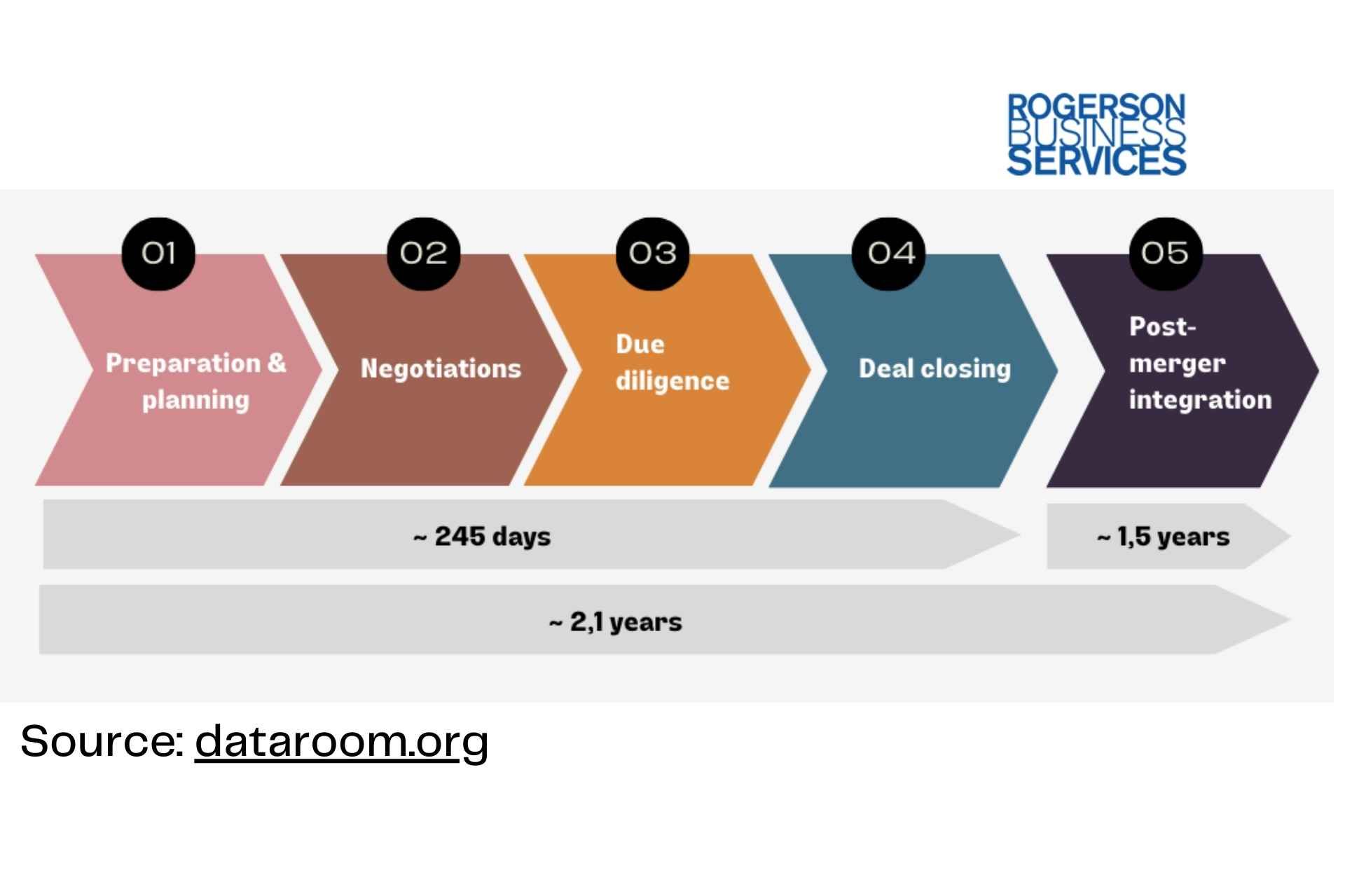

Visual Timeline of the Closing Process

Closing Process Timeline Explained

- Final Due Diligence Review: Both parties finalize their due diligence review, ensuring all necessary information has been gathered and verified.

- Document Preparation and Signing: Legal documents, including the purchase agreement, are finalized and signed by all parties.

- Funding and Escrow Deposit: The buyer secures funding for the transaction, and the funds are deposited into an escrow account.

- Recording of Documents: The necessary documents, such as the deed or bill of sale, are recorded with the appropriate government agencies.

- Closing and Transfer of Ownership: The transaction is officially closed, and ownership of the business is transferred from the seller to the buyer.

Importance of Legal Review

It is crucial to have an experienced attorney review all closing documents to ensure they are legally sound and protect the interests of both the buyer and the seller. An attorney can help identify potential issues, negotiate favorable terms, and ensure compliance with all applicable laws and regulations.

Understanding the Closing Process: A Simplified View

| Document | Purpose | Who Prepares It? |

|---|---|---|

| Bill of Sale | Transfers ownership of assets | Typically prepared by the seller's attorney |

| Deed of Transfer | Transfers ownership of real estate | Prepared by a title company or real estate attorney |

| Closing Statements | Outlines financial details | Prepared by the escrow company |

| Non-Compete Agreement | Restricts seller's competition | Negotiated and prepared by legal counsel |

| Employment Agreement | Defines terms of employment | Negotiated and prepared by legal counsel |

| Transition Services Agreement | Outlines post-sale support | Negotiated and prepared by legal counsel |

Expert Advice from Andrew Rogerson

"The closing process is a critical juncture in any business sale. By understanding the essential documents and engaging experienced legal counsel, you can ensure a smooth and legally sound transfer of ownership."

Fun Fact

California's robust business environment fosters a vibrant market for business sales and acquisitions. As businesses change hands, they contribute to the state's economic dynamism and create opportunities for both buyers and sellers.

FAQs

What happens if there are errors in the closing documents?

Call Now - Toll FreeIt's crucial to review all documents carefully before signing. If errors are found, they should be corrected immediately to avoid delays or legal issues.

For further questions, call the toll-free number below and record your concerns. We'll reply in 24 hours.

What if the buyer backs out at the last minute?

Call Now - Toll FreeThe purchase agreement should outline the consequences of a buyer's breach of contract, which may include forfeiting their deposit or facing legal action.

For further questions, call the toll-free number below and record your concerns. We'll reply in 24 hours.

How long does the closing process typically take?

Call Now - Toll FreeThe closing timeline can vary depending on the complexity of the deal and the responsiveness of the parties involved. It typically takes several weeks to a few months to complete the closing process.

For further questions, call the toll-free number below and record your concerns. We'll reply in 24 hours.

Downloadable Checklist of Closing Documents

Last Thought

Navigating the closing process can be complex. Ensure you have everything you need for a smooth and successful transaction. Contact Andrew Rogerson today for a free consultation and expert guidance on closing your business sale in California.

Further Reading:

Have Questions? We've Got Answers

We will get back to you as soon as possible.

Please try again later.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.

Sign up to our MMB newsletter

Thank you for joining us.

Check your email for our monthly newsletter

Please try again later

Reach out to any of our Deal Team & Advisors for a confidential conversation to see if we are a good fit.

We Help You Maximize The Value Of Your Business Before Selling it

Toll-Free

(844) 414-9600

5150 Fair Oaks Blvd, #101-198

Carmichael, CA, 95608

CA DRE# 01861204

Rogerson Business Services - Lower Middle Market Advisory

Read our Privacy Policy

Read our Accessibility Policy

M&A Knowledge Hub

THIS SITE IS DESIGNED AND POWERED BY INBOUNDEALZ