How to Value a Professional Services Business Based on Profit Multiples Calculation

How to Value a Professional Services Business?

- Step One: Use Income Multiple Approach

- Step Two: Increase profits

- Step Three: Hire an M&A Advisor

If you're tired of researching "how to sell my professional service company" because you have a baby boomer business for sale in the lower middle market segment, there are three business valuation methods for you to consider in California.

Based on years of experience and due diligence, we recommend the profit multiples calculation method for determining how to value a professional services business.

Valuation of a Service Company

When calculating the valuation of a professional services firm or baby boomer's business for sale, you have to think about a lot of factors. Fortunately, service company valuation multiples can make the process easier.

The income multiple approach is the best option for reasons such as:

- Simple to calculate

- Quick for financial analysts and business owners

- Uses relevant statistics for buyers and investors

Consider a couple of other valuation methods for a service company so that you complement income multiples and price your business accordingly.

Service Company Valuation Multiples

How do you value a service business? What do you do when you need valuation multiples for a service company? When building a service business for sale, it's important to plan in advance so that you can work on how to increase your company's value, especially important if you’re preparing to sell your business.

Below are ten essential items to focus on. These will help you determine the value of a company before you sell it and will highlight areas you can improve upon to increase your profits from the sale.

- Market size: If there is a bigger demand and lower supply for what your company offers, your company will have more value.

- Traction: If your company seems to be gaining traction and has high growth rates, investors will see it as having more value.

- Future financing: Investors will consider how many times they will have to inject the company with financing before it reaches a point of equilibrium and profit.

- Investor demand: A company has more value if there's investor demand to get in on what the company has to offer.

- Industry demand: If the company belongs to a "hot" industry in great demand, more people are likely to want to invest in it.

- Talent potential: If the company has a productive, high-profile team with experienced members, investors are more likely to invest in it.

- Existing clients: Companies are more stable if they already have a strong customer base.

- Trade name: A trade name's reputation can attract future customers and new talent. A company may also collect a small number of royalties from its trade name.

- Tangible assets: Tangible assets make up 20% of a company's value.

- General economy: Companies almost always have more value in a good than a bad economy.

Understanding how to value a professional services business involves knowing what can help you build and sell a service business. Think, how does a company create value that investors want? That will give you a beneficial guide on determining how to increase business value and how to sell a company the right way.

As you're investigating selling a service business tips, it's important to understand that there are a few categories of multiples valuation, such as enterprise and equity multiples.

If you work with an M&A advisor, they'll guide you through the best approach for arriving at an accurate profit multiples calculation based on your personal business situation.

What Is My Professional Service Business Worth?

Another vital part of preparing a business for sale checklist is to come up with the valuation for your professional services business. Of course, you can do this yourself using different methods, but we recommend hiring a business valuation professional so that you don't miss anything.

They can help you determine the right price so you can learn how to sell a business in California or any other state. That way, your service-based company can continue to grow with a new owner. The business owner can learn how to prepare to sell your business services company.

If you decided to build a business to sell, consider how you can increase business value:

- Optimize your procedures and systems

- Increase profit margins

- Manage cash flow and revenue growth

- Set up formal agreements with employees, customers, etc.

- Lower expenses

Knowing how to increase the value of your business can influence your decision on how to sell a service business. You'll be able to attract more buyers, so your service-based business may sell for more than another service-based company.

Hire an M&A Consulting Firm

Perhaps you're looking at a business services merger and acquisition instead of selling your professional service company to an individual. To sell a company this way, you may want to work with an M&A broker.

Good M&A advisors are great if you need someone to "help sell my business." They will have plenty of experience going through a merger and acquisition in the business services industry.

They can support your efforts to promote your lower mid-market business for sale to make selling your professional service company easier. A good firm will also be able to answer your questions, such as "how do I sell my company?" or “how to price your business for sale?”

The most important areas where they can assist are:

If you're looking to help with "how to sell my professional services company," M&A advisors are great. You can find someone specializing in middle-market companies for sale. Then, you can get the valuation that you want.

How Do You Sell a Company?

Statistically, the average American business owner has a minimum of 80% of their assets held in their business. Therefore, knowing how to value a professional services business is crucial when it comes to selling. You don't want to sell your business for too low, but you also need to generate a healthy supply of offers.

For this reason, we recommend using the profit multiples calculation for determining the value of your business. By comparing your company to other businesses with similar assets and services, you'll gain a quick and accurate picture of what your business is worth.

There's a lot of work and knowledge that goes into performing an accurate profit multiples calculation.

So, hire an M&A firm to walk you through the process. They can play a role in identifying areas for increasing your company's value, which will maximize the quality of your offers.

Download a valuation sample report. Click to download.

If you are a retiring business owner looking to exit your lower middle market service business in California, here are six tips to get you started:

1. Don't wait until the last minute to start planning your exit. The process of selling a lower middle market service business can take a long time, so it's important to start early.

2. Have a clear idea of what you want to get out of the sale. Know your goals and what you're willing to negotiate.

3. Know what's your company's worth. This is an essential step to take when planning to sell your service business company in California.

4. Choose the right type of buyer. Not all buyers are created equal, so do your research and find the right one for your business.

5. Be prepared for a lot of due diligence. M&A buy-side due diligence is when buyers will want to know everything about your business, so be ready to provide documentation and answer questions.

6. Be flexible with the terms and conditions of the deal. It's important to be open to negotiation to get the best possible deal for your business.

Rogerson Business Services, also known as, California's lower middle market business broker is a sell-side M&A advisory firm that has closed hundreds of lower middle-market deals in California. We are dedicated to helping our clients maximize value and achieve their desired outcomes.

We have a deep understanding of the Californian market and an extensive network of buyers, which allows us to get the best possible price for our clients. We also provide comprehensive support throughout the entire process, from initial valuation to post-closing integration.

Our hands-on approach and commitment to our client's success set us apart from other firms in the industry. If you consider selling your lower middle market service business, we would be honored to help you navigate the process and realize your goals.

If you have decided to value and then sell your lower middle market service company or still not ready, get started here, or call toll-free 1-844-414-9600 and leave a voice message with your question and get it answered within 24 hours. The deal team is spearheaded by Andrew Rogerson, Certified M&A Advisor, he will personally review and understand your pain point/s and prioritize your inquiry with Rogerson Business Services, RBS Advisor

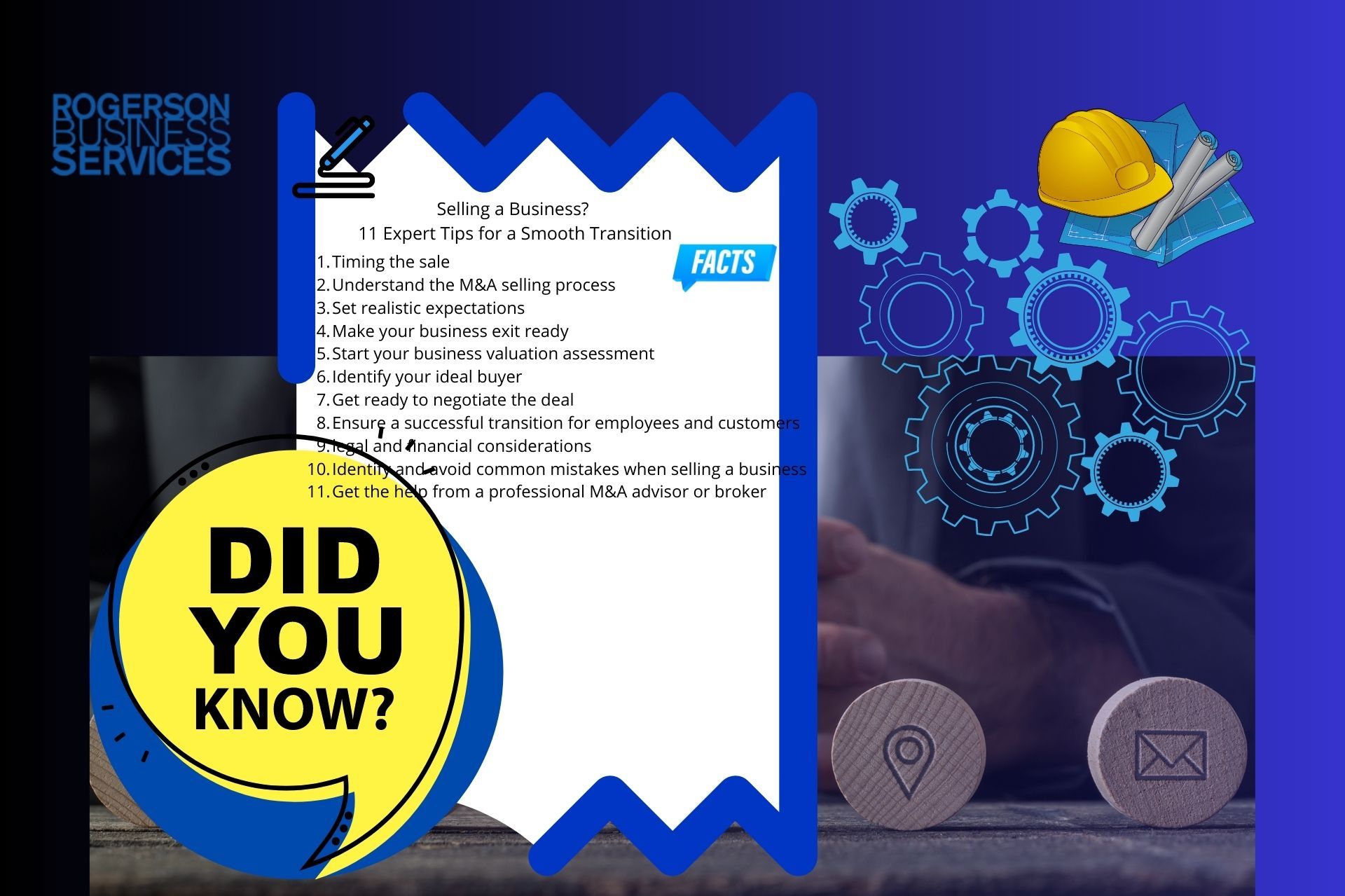

Go to the next article: Part of tips to

selling business services company

in California

series ->

More Tips to Help Sell a Lower Middle Market Business Services Company

Have Questions? We've Got Answers

We will get back to you as soon as possible.

Please try again later.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.

Sign up to our MMB newsletter

Thank you for joining us.

Check your email for our monthly newsletter

Please try again later

Reach out to any of our Deal Team & Advisors for a confidential conversation to see if we are a good fit.

We Help You Maximize The Value Of Your Business Before Selling it

Toll-Free

(844) 414-9600

5150 Fair Oaks Blvd, #101-198

Carmichael, CA, 95608

CA DRE# 01861204

Rogerson Business Services - Lower Middle Market Advisory

Read our Privacy Policy

Read our Accessibility Policy

M&A Knowledge Hub

THIS SITE IS DESIGNED AND POWERED BY INBOUNDEALZ